The government, CBI adopt a comprehensive initiative for banking reform

- 4-02-2025, 17:43

INA - BAGHDAD

The government, in cooperation with the Central Bank of Iraq - CBI, adopted on Tuesday a comprehensive initiative for banking reform.

"Banking reforms have been a cornerstone of the economic reform agenda outlined in the government program. To advance the critical steps initiated by the government in this area since assuming office - and to achieve key development objectives that require a robust banking sector - the government, in collaboration with the CBI, has launched a comprehensive initiative encompassing a strategic and integrated set of banking reforms," according to a statement by the PM Media Office - received by the Iraqi News Agency - INA.

The statement included that "this initiative marks a pivotal moment in Iraq’s economic development, aligning with commitments to enhancing banking standards, strengthening financial resilience, and fostering a more competitive financial system."

"These comprehensive reforms aim to keep pace with developments in the region and globally, facilitate greater partnerships, and expand Iraq’s connectivity with international banking and financial systems. CBI is actively working to implement and refine regulatory and supervisory frameworks in cooperation with international partners to promote sustainable growth and development within the banking sector. At the same time, the government is supporting the CBI’s efforts to enhance the overall banking environment," added the statement.

These reform efforts are built upon the following key pillars:

1- Enhancing ownership structures and governance frameworks

Strengthening transparency and accountability by implementing measures such as diversifying ownership structures and ensuring independent board oversight of operations and committees.

2- Improving service standards

Expanding access to essential financial services for all Iraqis by increasing efficiency, diversifying financial products, and modernizing the banking sector’s infrastructure.

3- Aligning with international standards

Enforcing adherence to globally recognized frameworks and best practices in anti-money laundering and countering the financing of terrorism, as well as financial transparency, to ensure the seamless operation of banking services and support both business needs and individual financial transactions.

4- Enhancing financial resilience

Strengthening the financial stability of Iraqi banks by implementing robust capital and liquidity requirements, ensuring the protection of customer deposits, and safeguarding the economy against domestic and international challenges.

This initiative is part of a broader strategy aimed at modernizing Iraq’s banking sector. The CBI is currently developing this strategy in partnership with Oliver Wyman, a leading global management consulting firm. The ongoing banking reforms, including those undertaken with state-owned banks, will complement this strategy, marking a transformational shift in Iraq’s financial system.

"Further details on the implementation of these reforms will be announced in due course."

With this initiative, the government and the CBI reaffirm "their shared commitment to a reform vision that establishes a modern, transparent, and inclusive banking system - one that supports the aspirations of Iraq’s dynamic economy."

Gaza Health Ministry Announces New Death Toll for Zionist Aggression

- International

- 06:04

Al-Maliki: Iraq Managed the Electoral Process Smoothly

- politics

- 05:18

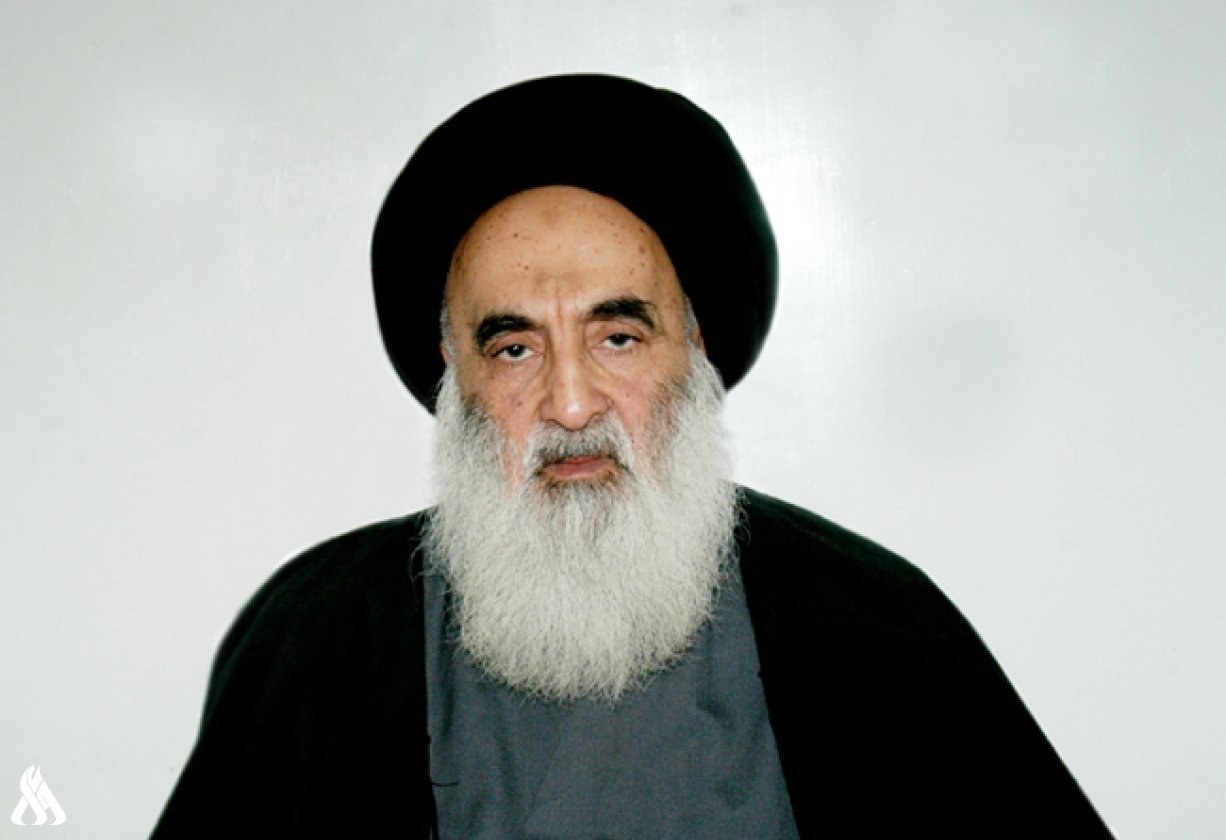

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01