INA discusses 14 important files with CBI Governor

- 24-11-2023, 12:49

Baghdad-INA

The Governor of the Central Bank of Iraq (CBI) announced on Friday, the start of the inward supply of dollars through the accounts of Iraqi banks abroad.

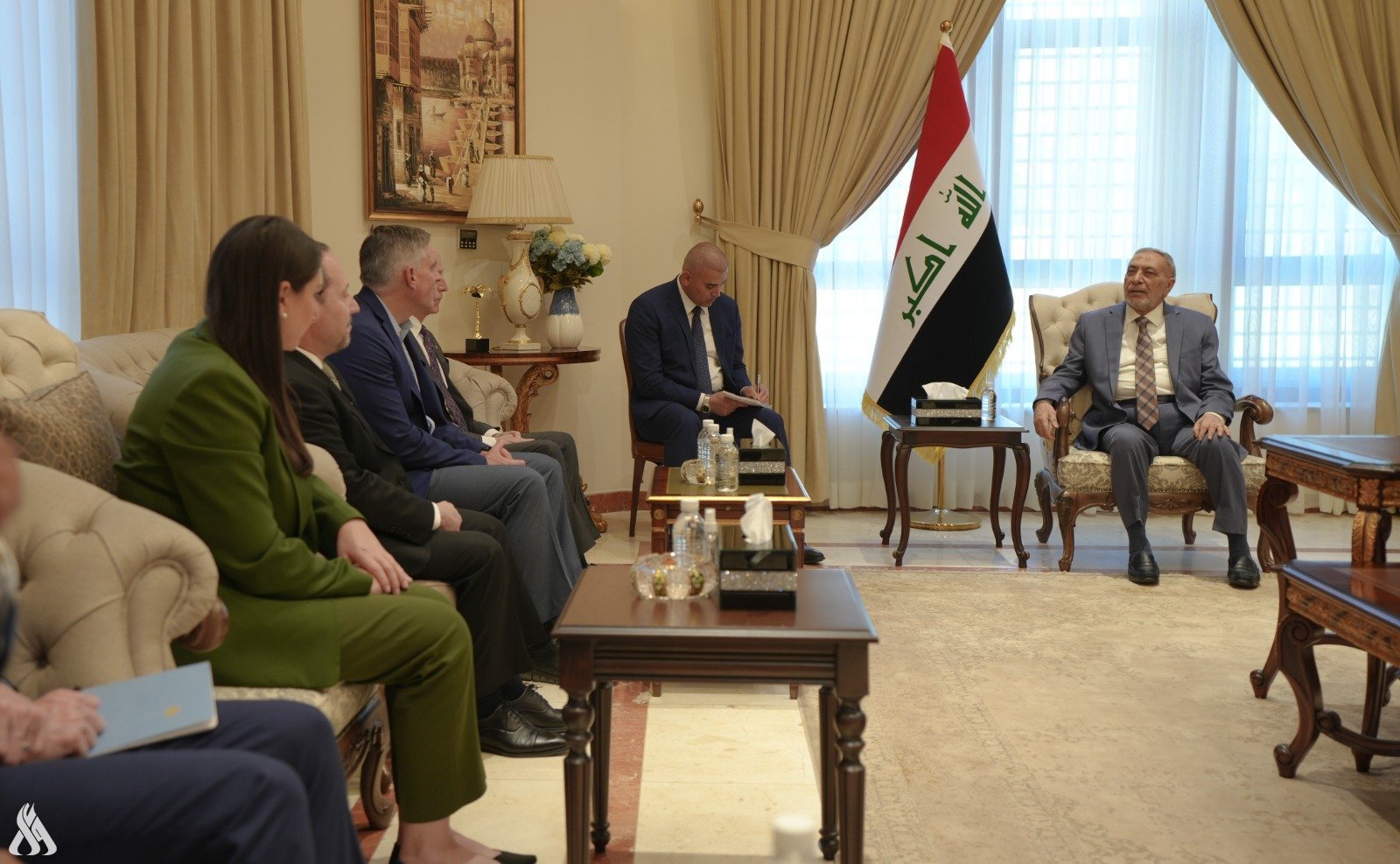

Meeting with the US Treasury and the Federal Reserve

Al-Alaq said in an interview with the Iraqi News Agency (INA), that “the Central Bank of Iraq is in constant contact with the US Treasury Department and with the US Federal Reserve,” indicating that “This communication continues permanently, and there are quarterly meetings held to review all related matters within the framework of this relationship.”

"There will be a meeting at the beginning of next month as part of the quarterly regular meetings between CBI, US Treasury and the Federal Reserve, where we will review all matters with emphasis and focus on the subject of regulating external transfer in order to ensure the integrity of the financial system, especially after using the new system of external transfer, which requires much coordination," he added.

He stated that "These developments have been radical rather than formal in the context of properly structured trade and properly regulated external transfer", noting that "details on this subject require coordination and cooperation between the Central Bank and those sides."

The agreement to boost banks with dollars

"The Federal Reserve agrees with CBI that they should be away from the process of making operational aspects of the external transfer and their role is limited to supervision and control. And this is normal in central banks that do not exercise these executive roles or detailed processes in relation to external transfer, Therefore, the plan and the agreement between us were being away from these procedural processes, affirming a plan for the transfer of external transfers from the electronic platform, which will be completed early next year, " he continued.

Opening more than 40 bank accounts

He stated: “We have greatly succeeded in this regard, as we were able to open more than 40 accounts for Iraqi banks with correspondent banks or abroad.”

Currency diversification

"To increase flexibility and ease the process of external transfer, we have diversified the currencies in which transfers are made abroad, and we now have transfers in dollar, euro and UAE dirham."

Discussions to make transfers through Turkish banks

“The procedures have been completed for opening accounts in the dirham, the Chinese yuan, and the Indian rupee,” he said. Noting that “there are preliminary understandings with the Turkish side to make transfers through Turkish banks in the euro or the Turkish currency.”

"This case is important and is being coordinated with the Federal Reserve and the US Treasury and they are helping us with this." He noted. “This is the opposite of what some thought as an escape from the pressures of the Federal Reserve in relation to the dollar, these currencies are covered in dollars and we buy them from the dollar in the Federal Reserve with its coordination and support, as it wants to reach with us the desired goal, which is to have a relationship between Iraqi banks and correspondent banks.”

"This is the first time that we have opened this number of accounts to our banks, which is a very important step to strengthen the banking system in Iraq because the accreditation of these banks means that they have systems capable of being internationally acceptable."CBI governor affirmed. "Any current correspondent bank accepts to open an account for an Iraqi bank after confirming that the bank possesses the necessary regulations, standards, conditions and rules under which it operates."

The electronic platform

Al-Alaq confirmed that “this will lead to the end of using the electronic platform in 2024,” explaining: “We have reached an advanced level, and with the completion of the other steps, we will leave using it.”

He stated, "In this case, operations will be faster, easier, and more disciplined because these internationally accredited correspondent banks have complete systems for conducting audit and monitoring operations before implementing this operation."

Processing rejected transfers gradually

He noted that "This step will gradually reduce the proportion of rejected remittances", The refusal of remittances has reasons, but banks and persons who make the transfers will learn the conditions and points to be observed when applying for remittance since there are formal issues, such as coding and numbering, and a required documentation and review of the end beneficiary is that there are known companies, reasonable prices and so on, and over time the importer or applicant is accustomed to adapting or providing the requirements for the transfer."

The fact that the American side reduced the amount of dollars

“The Federal Reserve Bank and the US Treasury respond to all requests related to the process of providing and boosting the dollar Iraq needs by following sound rules and standards for the money flow,” explaining that “this serves the interest of both countries and rids the financial system of any suspicious operations such as money laundering and terrorist financing operations, so the money abroad is Iraqi money with no restrictions, but there are requirements and standards, whether in the dollar currency or even if it is in European currencies or other currencies, and these have become among the required rules in all circumstances.”

He continued, "Some people believe that if this money were in another country, it would be without restrictions, but these have become international standards followed, even if it was in euros, yuan, or pounds sterling, and there will be the same business rules."

Expanding the diversification of foreign transactions for all Iraqi banks

"Our goal is that all banks must have correspondent banks, and we have confirmed this issue for years, as a bank that does not have correspondent banks, it cannot do its real business and will discontinue from the world," He explained. “Some banks were late in depending this matter as the easy methods were available, so some did not bother to work seriously on this issue, but now all banks have realized that there is a necessity, so they began to adopt this system successively.”

He added: "Whenever the bank provides the correspondent bank with the fact that it has the required system to control the movement of funds, provide conditions and follow international standards, and the existence of a system to control the issue of money laundering and terrorist financing will enter this field faster," he said, noting that "some banks have started to hire international companies competent to regulate these aspects until they become eligible."

Import of various currencies comes into effect

He pointed out that "import operations in various currencies have entered into force. For example, with the Chinese side and the euro, they were initiated some time ago, and the UAE dirham will begin next week."

Reducing the demand for the dollar

He stated, “These measures aim to reduce the pressure on the demand for the cash dollar, as we want all importers to carry out import operations through fundamental external transfer, but some trader in Iraq does not follow this way, but rather goes to put pressure on the dollar cash present in the market Therefore, there is an imbalance in the price, That is, it is the result of the presence of groups that put pressure on cash while there are correct and fundamental procedures for transfer available,”

He announced “working with the government to eliminate the steps that put pressure on the cash exchange rate, and we found for example, some deal in cash dollars inside Iraq, so The government issued a decision that it is not permissible to deal in the dollar locally. As for the second group, they are the merchants who import some materials and do not enter the platform or transfer money in the proper way. We began to analyze these categories, such as the cigarette trade, which takes the dollar from the market by 100 percent. We also began to analyze the materials that enter Iraq, such as some mobile phones and other materials. A decision was issued that these materials must have proof that they entered Iraq based on External legal transfer so If these goods does not carry an official legal transfer, this means that it is a good that entered illegally.

Market Monitoring

"There will be market follow-ups, even in warehouses, to make sure that these materials come in on an official transfer in order not to put pressure on the dollar market and we will expand that into other categories, and any category we find to be making non-fundamentalist transfers or cash payments we will be detected."

Iraqi remittances in dollars

He affirmed that " the general principle of the Council of Ministers that trading or paying in Iraq is in dinars, but there are cases currently being studied, and there was a meeting in the Ministry of Planning with regard to the various forms of contracts and how to pay in dinars or dollars, where a series of proposals have been put forward and now we are studying them. Some types of contracts or obligations with former foreign companies will continue to be dealt with in dollars, and we study other cases to establish the best or most appropriate way for them."

He pointed out that "in the past, inward transfers did not matter to the beneficiary if they were given in dinars, but now, because of the price difference, it is a temporary solution and we are working to solve the problem radically."

The mechanism for private banks importing dollars

Al-Alaq announced the start of importing dollars into the country from the accounts of Iraqi banks abroad, explaining that “the supply of dollars from abroad comes from what is in the accounts of Iraqi banks abroad. For example, we have an account in a bank, so we can withdraw it in cash or a check, and it is transferred in cash, there are benefits, including that the amounts come internally instead of externally.”

He explained that the instructions of the Central Bank will not allow the bank to keep a large amount of foreign currency abroad, as there are certain percentages, in addition to preventing misuse of this currency coming into the country, and we have set rules for its use.

He warned that "the Central Bank is studying the request of the bank that supplies the dollar and its needs before giving approval and verifying the source of the amount and even the transporting company, in addition to verifying the uses of this amount."

A study to restructure banks in Iraq

Al-Alaq stressed that “there is a broad reform plan for private banks with mergers and correction operations in some of their situations, and there is a broad plan for government banks, some of its details will be announced, and we are working with Prime Minister Muhammad Shiaa Al-Sudani on this matter,” pointing out that “Government banks represent the greatest value of the banking sector, and we must put them as best as possible."

Duhok of Iraq and Qadsia of Kuwait match kicks off

- Sport

- 25/04/15

Four Daesh terrorists detained in Salahuddin

- Security

- 25/04/14

Two ISIS hideouts destroyed, killing those inside in Salah al-Din

- Security

- 25/04/13

Date Set for 'El Clasico' Final of the Copa del Rey

- Sport

- 25/04/12