Arab Monetary Fund: Collaborating with Iraq to Build National Financial Strategies

- 14-09-2024, 14:06

Baghdad – INA

Fahd bin Mohammed Ali Al-Turki, Director General and Chairman of the Board of the Arab Monetary Fund, affirmed on Saturday, the organization’s commitment to working with Iraq to develop national financial strategies through well-known and technical programs.

In his address at the conference on electronic payments aimed at achieving financial stability in Iraq, Al-Turki stated, “The various regulatory capacities have played a fundamental role in creating a digital regulatory environment that stimulates banks and financial institutions to employ modern technologies for digital transformation and banking services, enhancing their efficiency and mitigating risks, including cybercrime.”

He added, “In this context, the governing legislation, electronic financial transfers, consumer protection in the digital financial sector, and anti-money laundering requirements must achieve a balance between encouraging digital transformation on one hand and managing and mitigating risks on the other.”

Al-Turki continued, “A well-designed payment system and ensuring environmental control among them and their interconnection with other systems, such as credit systems, can enhance the efficiency of digital transformation and economic growth opportunities,” noting that “digital transformation is a fundamental factor in reshaping the banking sector in the Arab region.”

He pointed out that “governments and central banks can play a role in supporting digital transformation by establishing a digital regulatory framework, as evidenced by investments in digital infrastructure and addressing cybersecurity challenges, which helps create an environment that fosters innovation and growth in the banking sector.”

He expressed satisfaction with the remarks made by the Governor of the Central Bank regarding ongoing efforts in many of these areas, emphasizing that “a robust regulatory framework is crucial for promoting digital innovation, and governments should focus on ensuring equal opportunities and that regulatory frameworks are consistent to reduce risks.”

Al-Turki explained that “investing in digital infrastructure can stimulate digital banking services that enhance access to banking services and products for both users and non-users of the financial system.”

He further stated that “the Arab region has renewed its financial technology companies, with the number of such companies reaching approximately 1,500 by the end of the first half of 2024, compared to fewer than 300 four years ago in global and regional financial activities.”

He added, “Significant global statistics present enormous investment opportunities in this sector, with total investments in modern fintech reaching approximately $115 billion in 2023, and it is expected to continue growing significantly to reach $325 billion by around 2026. According to the International Finance Report, the Arab region has faced varying attacks over the past four years, and there exists a digital divide.”

He continued, “A digital gap persists between developing and developed countries, limiting the spread of digital payments in certain regions, alongside reliance on technology without creating alternative systems, which makes digital payments vulnerable to disruptions in case of any technical issues.”

Al-Turki highlighted that “with the increasing number and expansion of financial transactions, the use of artificial intelligence emerges in this context, as it can significantly contribute to analyzing vast amounts of data in a short time and identifying unusual patterns that may indicate fraudulent activities.”

He explained that “this is achieved using machine learning techniques that learn from previous data and accurately and swiftly identify suspicious normal and abnormal patterns, as well as monitor and analyze the behavior of users of financial services to ensure compliance with regular payment patterns. If any unusual activity is detected, the system can send immediate alerts to verify transaction validity. Furthermore, AI technologies enhance digital identity applications, such as voice recognition, to verify user identity before completing financial transactions, increasing security levels.”

He noted that “the Governor of the Central Bank of Iraq mentioned several key points, particularly regarding investment in infrastructure through the extensive use of mobile phones, especially in remote areas, and the development of agency networks to meet the needs of individuals for cash withdrawal and deposit operations at the local level, as well as the distribution of digital identity frameworks, including biometric systems and expanding open application programming interfaces that are publicly accessible to allow developers to access proprietary software so that new applications can communicate and interact with each other.”

Al-Turki further emphasized the need to “develop legal and regulatory frameworks that allow financial service users to organize their benefits and ensure a competitive environment while considering whether non-banking institutions should be allowed access to national payment infrastructure and how to do so, alongside enhancing supervisory capabilities to mitigate risks and promote financial and digital literacy.”

He stated that “modern financial technologies play a significant role in achieving financial inclusion goals. In recent years, collaboration between institutions and stakeholders in the financial sector, supported and encouraged by Arab central banks, has led to real progress in financial inclusion levels in the Arab region, as central banks, financial service providers, and government agencies have embraced fintech to expand access to financial services for non-banking sector users, according to the global Tex index database and the World Bank.”

He concluded by stating that “there has been a significant increase in the adoption of digital financial services in the Arab region, especially after the COVID-19 pandemic, with the percentage of adults rising from 30% in 2017, driven by the expansion of mobile services, and the mission of distributing access to digital services in rural areas. He acknowledged the ongoing collaboration between the Arab Monetary Fund and the Central Bank, whether through the active participation of the bank’s personnel in committees arising from the Council of Governors of Arab central banks or through well-known technical programs with the Central Bank of Iraq that contribute to building national strategies for financial contributions.”

La Liga continues to pressure Barcelona

- Sport

- 09:47

Zionist airstrikes target the Damascus countryside

- International

- 09:07

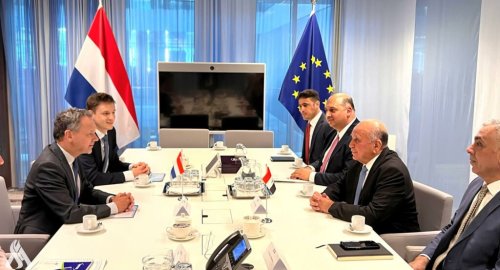

Foreign Minister Invites Dutch Counterpart to Visit Iraq

- politics

- 06:38

Iraq Condemns Zionist Airstrikes on Syria

- politics

- 06:36

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01