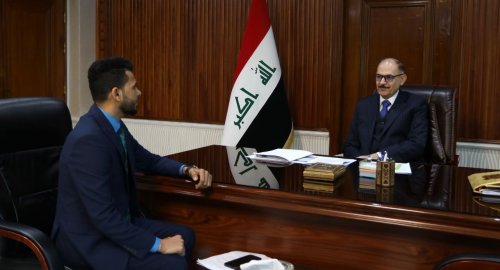

INA interviews vice president of Rusafa Court of Appeal concerning money laundering and Curbing corruption

- 27-10-2023, 11:41

INA- BAGHDAD

The Anti-Money Laundering and Anti-Corruption Investigation Court clarified on Friday the details of the money laundering mechanism and the most common cases, while referring to money laundering invested in gas stations, malls and asphalt plants, it confirmed that the Central Bank's procedures imposed strict control over the amounts deposited and withdrawn.

Duties and tasks of the court

Vice president of Rusafa Court of Appeal, senior judge at the Anti-Money Laundering and Anti-Corruption Investigation Court, Iyad Mohsen Dhamad, told the Iraqi News Agency (INA), that "the name of the court indicates its competencies and duties, it is the Rusafa Investigation court specialized in considering integrity, money laundering and economic crime cases, where our court specializes in considering financial and administrative corruption cases, regardless of whether they are cases of bribery, embezzlement, breach of job duties or illegal gain through inflation in the Financial the penal provisions in the Iraqi Penal Code and the law of integrity and illegal gain".

He added that " our court is qualitatively competent to consider anti-laundering issues, "explaining that "our court also specializes in considering issues harmful to the national economy, such as speculation at the dinar exchange rate against the dollar, issues of transferring money outside Iraq without official permission, smuggling antiquities, counterfeiting currency, human trafficking, crimes related to the product, trademark counterfeiting, public health and others.

Cooperation with other devices

He continued that "the official agencies with which our court cooperates to accomplish its tasks in investigating the cases considered by it are the Baghdad Investigation Directorate of the integrity commission for financial and administrative corruption and graft cases, the Directorate of combating organized crime at the Ministry of Interior for crimes harmful to the national economy, and the anti-human trafficking section for human trafficking crimes," explaining that "cooperation with the bureau of anti-money laundering and terrorism financing at the Central Bank of Iraq is a basic cooperation, It is a priority that the said bureau carries out the main task in the field of submitting suspicion reports to the court on suspicions of money laundering and terrorist financing, as well as the office carries out the task and responsibility of Iraq's compliance file to the FATF in the field of combating money laundering and terrorist financing, and our court represents the Supreme Judicial Council in providing the requirements for that compliance and unites many cooperation tracks in this area contributed to raising the level of Iraq's compliance among other countries."

The most common money laundering cases

He pointed out that "among the requirements of the FATF is that countries prepare a national strategy to combat money laundering, as well as prepare a national risk report to identify weaknesses and threats in the field of combating money laundering," noting that "the national risk report prepared by our court jointly with a group of institutions and the Anti-Money Laundering Office showed that the most common pattern of money laundering is self-money laundering."

"This pattern is where money launderer records the financial gains of criminal activities in his name, and sometimes the pattern of laundering is attended by the third party through some friends or the money launderer's wife, children and brothers," he said, noting that "the most sectors in which the money obtained from crimes was invested is the real estate sector, exchange companies and the gold sector."

"The means used in money laundering are to collect money gained from crimes, and then use it in the process of buying real estate, land, shares and companies," he said.

Iraq's losses due to systematic theft

"Talk about Iraq's loss of more than a trillion dollars through systematic theft is inaccurate, as there are accurate figures adopted by an official institution through which the waste and loss that affected Iraqi public money since 2003 can be counted," Judge Dhamad said, explaining that "there is a difficulty in determining the exact figures."

He pointed out that "it is agreed that the financial and administrative corruption that accompanied the performance of Iraqi state institutions caused the loss of funds for many reasons, including related to mismanagement and waste, including embezzlement and theft, and these figures are constantly decreasing due to the policies of governance and transparency followed by the Iraqi government and the proactive measures followed by some institutions concerned with auditing such as the Financial Control Bureau or effective recovery of gains of crime Corruption and confiscation, as well as in the issuance of deterrent sentences to defendants in cases of financial and administrative corruption".

Public money thieves turn to businessmen

He pointed out that "many of the perpetrators of financial and administrative corruption crimes, drug dealers and the perpetrators of the rest of the crimes were able during previous years to enter the market of businessmen and investors, the reason for this is the delay in the legislation of the law on graft, which was initiated only in 2019 after the amendment of the integrity commission law," pointing out that "the said law is limited in its provisions to employees who hold senior administrative positions, and it does not include workers in the private sector, in addition to the poor performance of financial institutions and regulatory institutions that oversee the investment and trade sector and although some of them are related to original crimes".

Money laundering carried out under the title of investment

He pointed out that "money laundering cases entitled investment not only in Iraq, but in most countries of the world, where money launderers resort to the industrial and commercial investment sector to legitimize the funds obtained from crimes, and here lies the difficulty of tracking the laundered funds to use complex and many methods in passing them and legitimizing them," pointing out that "the entertainment venues sector, the real estate sector and the sector of investment companies were present among the methods used in laundering the gains of crimes and through the work of the court and the investigations conducted, it turned out that some of the money was invested in gas stations, in the establishment of exchange companies, in some of them are in asphalt factories, transport companies, and in construction of shopping centers and commercial malls".

Depositing Iraqis ' money in banks

He stressed that "the development made by the Central Bank of Iraq in anti-money laundering regulations and the imposition of these regulations on private and government banks and the anti-money laundering and Terrorist Financing Law No. 39 of 2015 of due diligence procedures that banks must comply with when dealing with customers, whether when opening an account or when conducting any financial transaction, This has led to the imposition of strict control over clients, customers and the amounts of money deposited and withdrawn," he explained, explaining that "in the event of any suspicious financial operations, the financial institution is obliged to submit a report to the anti-money laundering and terrorist financing bureau to investigate the truth and if there are indications of suspicion, a suspicion report is prepared and referred to our court to begin criminal investigation procedures to detect money laundering crimes associated with suspicious financial transactions.

He stated that" the more banks control over customer transactions, the tighter the rings on money launderers and vice versa, "explaining that "during the previous years of the court's work, legal proceedings have been taken against many bank employees due to lack of due diligence towards customer transactions and financial and penal sanctions were imposed on them in accordance with the anti-money laundering law".

He pointed out that" there are 68 accused of human trafficking cases, and they were investigated, in addition to 70 accused of money laundering, and 40 accused of smuggling antiquities," pointing out that this statistic is in Rusafa only since the beginning of 2023 until now.

"These cases have been referred to the competent criminal courts for sentencing," he explained.