CBI proceeds increasing (POS) services in accordance with the decision of the Cabinet

- 1-06-2023, 10:53

INA- Baghdad

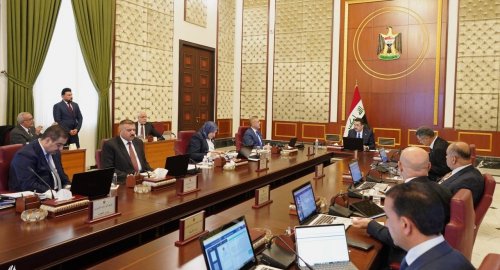

The Central Bank of Iraq CBI announced Thursday the start of increasing electronic payment devices (POS) in accordance with the decision of the Cabinet.

A statement by the Central Bank, received by the Iraqi News Agency (INA), stated, "The Central Bank of Iraq has begun implementing Cabinet Resolution No. (23044) of 2023, which includes providing electronic payment service (POS) in the government and private sectors."

The statement added, "This decision aims to enhance electronic payment and reduce the use of paper money in commercial payment and collection operations, as points of sale and various electronic payment methods will be used to facilitate electronic collection operations in effective, reliable and flexible ways."

It pointed out that "necessary steps have been taken by the ministries concerned with collection to deploy POS devices for electronic collection purposes," noting that "the relevant ministries, agencies and government departments, such as the Ministries of Interior, Electricity, Transport, Oil and Trade, the Housing Fund and the Municipality of Baghdad, have begun to use electronic payment gateways and Installing point-of-sale (POS) devices to facilitate direct dealings with citizens, while preserving the citizen's right to choose the payment method that suits him.

CBI expected that "other government institutions and departments will join this service in the coming days, which will contribute to expanding the use of electronic payment in the country."

It also pointed out that "the response from the private sector was very encouraging, as point-of-sale devices were spread in commercial centers, delivery companies and licensed taxi companies, in addition to universities and private hospitals."

The Central Bank of Iraq suggested that “the implementation of this decision will have a significant impact at the country level, as it enhances effectiveness and efficiency in collecting revenues, provides advanced financial services to citizens, contributes to digital transformation, strengthens governance, and improves the efficiency of collection and financial collection, and also contributes to increasing transparency and reducing errors.” in financial operations.

It explained, "The Central Bank of Iraq is looking forward to achieving great progress in the field of electronic payment in Iraq," considering that "this measure is a necessary step towards building a strong foundation for achieving financial stability and economic growth."

Iraq vs Saudi Arabia match kicks off, Arabian Gulf Cup 26

- Sport

- 24/12/28

Real Madrid becomes Arnold's new home

- Sport

- 24/12/28

Globe Soccer Awards 2024: all the nominees

- Sport

- 24/12/27