Oil prices make up for losses as investors take risks and increase Chinese demand

- 19-10-2022, 09:56

INA- SOURCES

Oil prices rose on Wednesday, recovering losses incurred in the previous session, as investors turned to riskier assets such as commodities amid gains in stock markets and signs of renewed demand in China, the largest oil importer.

By 04:55 GMT, Brent crude futures for December settlement rose 46 cents, or 0.5%, to $90.49 a barrel.

US West Texas Intermediate crude for November delivery recorded $83.69 a barrel, an increase of 87 cents, or 1.1%, according to “Reuters”.

In the previous session, Brent crude fell 1.7% and US crude fell 3.1% to its lowest level in two weeks, due to reports that US President Joe Biden intends to withdraw more barrels from the Strategic Petroleum Reserve.

Oil prices also received a boost from risk appetite, which rebounded thanks to encouraging US corporate earnings and rising stock markets.

“The slight rise in oil prices is likely due to the high sentiment in stock exchanges and the return of risk in trading,” said Sophro Sarkar, senior energy analyst at DBS Bank in Singapore.

Prices were also supported in light of signs of recovery in Chinese demand, as the private refining giant Zhejiang Petrochemical Corp. obtained an additional quota for importing crude oil in 2022 of 10 million tons.

European Union sanctions on Russian oil will come into effect in December and February, respectively.

To fill the gap, Biden will announce a plan later on Wednesday to sell the remaining SPR, and reveal details of a strategy to refill the stockpile when prices fall, a senior administration official said.

The official said the US administration plans to sell 15 million barrels of its reserves in December, the last batch of 180 million barrels withdrawn this year.

Inventory data from the Energy Information Administration, the statistical arm of the US Department of Energy, is due later Wednesday.

SOURCE: trend detail

La Liga continues to pressure Barcelona

- Sport

- 09:47

Zionist airstrikes target the Damascus countryside

- International

- 09:07

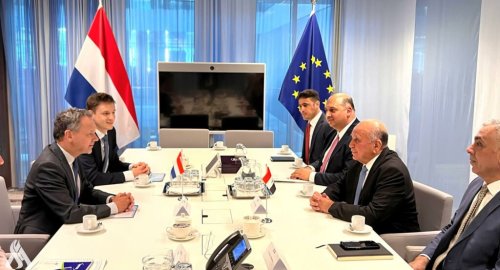

Foreign Minister Invites Dutch Counterpart to Visit Iraq

- politics

- 06:38

Iraq Condemns Zionist Airstrikes on Syria

- politics

- 06:36

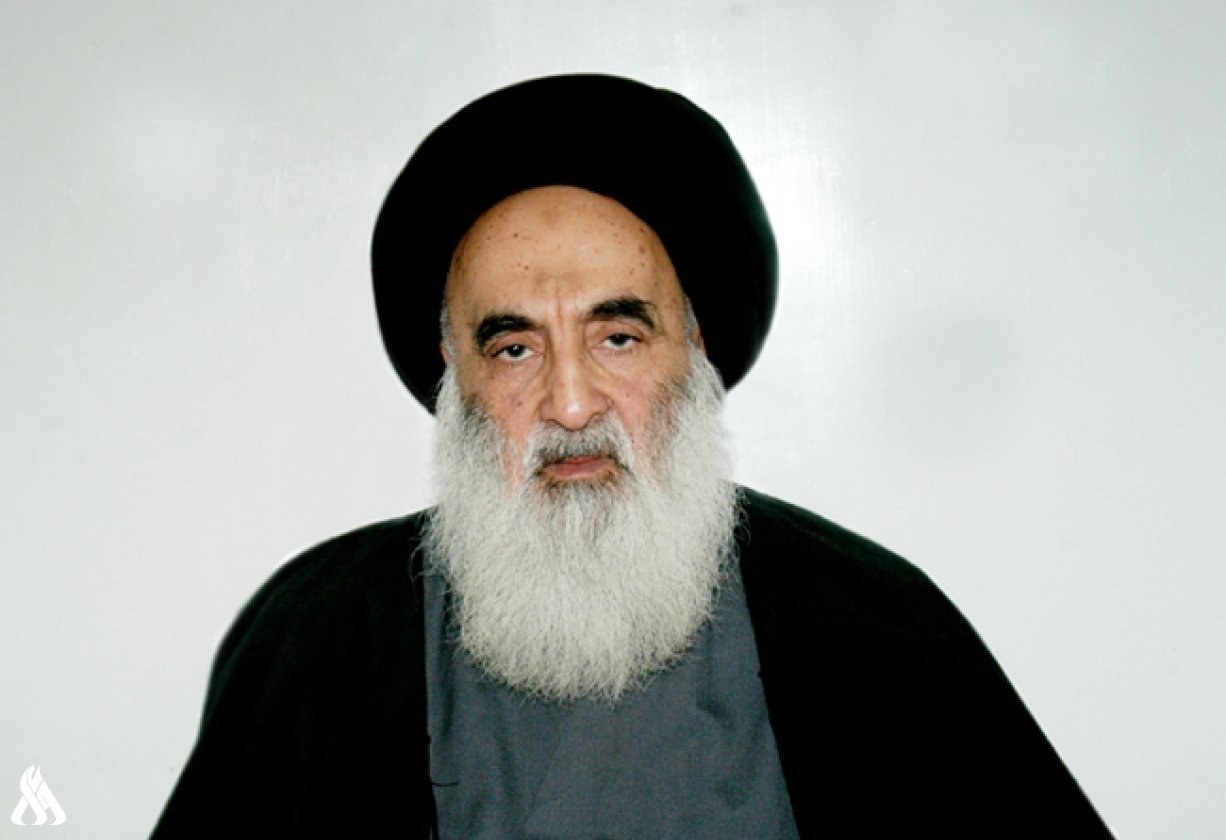

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01