Recovering oil prices, would it help getting rid of borrowing in 2022 budget?

- 23-10-2021, 22:00

INA - BAGHDAD - LIVE UPDATES

Nassar al-Hajj

Hopes for Iraq's general budget 2022 would be free of borrowing, after oil prices recently reached $85 per barrel, with expectations of an increase to $100 next year.

In this case, Iraq will not fall into borrowing again, as happened this year following the economic crisis, coinciding with the outbreak of Corona.

Where are oil prices heading?

The economic expert, Nabil Jaafar, said in a statement to the Iraqi News Agency (INA), that "the path of global oil prices is constantly rising and hovering around $85 due to many factors, including global economic openness, the success of the vaccine against Corona and the restoration of global economic growth," noting that "these measures led to strong demand in the global oil market in the face of limited supply resulting from the restrictions of OPEC Plus, and also caused by the inability of some OPEC Plus countries to restore their production capacities, especially Angola, Japan and Nigeria, in return for strong demand, especially due to the high prices of coal and gas,”

“There is an additional demand for crude oil for the purposes of using it as a fuel in electric power plants, and therefore it is hoped that oil prices will continue to rise unless three factors occur,” added Jaafar.

He explained, "These factors are based on to have a warm winter in the Western Hemisphere, OPEC Plus to cancel the production restrictions which it has committed to in 2020, and the United States of America to withdraw strategic oil stocks,”

“If these factors do not occur, oil prices are likely to continue and may reach $90 or more than this figure at the end of this year,”

Will Iraq benefit from this rise?

The economic expert noted that "the significant rise in crude oil prices has positive repercussions on Iraq's general budget for 2021, which was established by fixing the oil price at $45," noting that "Iraq needs a barrel price of $71 and 30 cents in order for public expenditures to balance public revenues and for a period of whole year time,”

He pointed out that "in the event that oil prices continue to rise for the remaining three months, we may obtain a surplus estimated at four billion dollars, and Iraq will be able to pay the debts, whether external or internal, and thus borrowing will also decrease,”

“There is a need to take advantage of this rise, through reconstruction and investment funds, by reserving a certain percentage of oil revenues for the purpose of employing it in the establishment of some strategic projects, as well as investing it in the Generations Fund or the Sovereign Fund,”

In turn, the economic expert, Basim Antoine, said, in an interview with the Iraqi News Agency (INA), that "the significant rise in oil prices would eliminate the deficit in the general federal budget of Iraq with a phenomenon that is the first of its kind, and therefore this opportunity must be invested, as it may be for a specific period,”

“It is needed to invest in this rise through the reconstruction of many areas in Iraq and the creation of support for the private sector and other measures directed towards investment to create a job opportunity and achieve real benefit,” he noted.

Antoine suggested that "the presence of alternative energy, which is being worked on currently, would limit the significant rise in oil prices. There will be a natural increase so that it does not reflect negatively on the rest of the prices of goods, and this increase may go to countries that were a major cause of price reduction,”

Will oil prices continue to rise?

The oil expert, Hamza Al-Jawahiri, expected, in a statement to the Iraqi News Agency (INA), that "oil prices will find great resistance before reaching $90, because most OPEC countries do not accept this price, but rather find that the fair price is $70,”

"OPEC has realized that the stocks of industrialized countries are starting to deplete, and it is waiting to drain those quantities of speculators who are waiting for the highest possible price to achieve the highest profits,” indicated Al-Jawahiri.

Al-Jawahiri explained that "the rise in prices may lead to a return to unconventional oil production, and encourage producers or developers of clean energy production technology to work at a higher rate, and this means the entry of a strong competitor that competes with fossil energy,”

He stressed that Iraq will benefit from this rise to cover the hypothetical budget deficit as well as other expenses that are approved in the budget, in addition to other expenses that have been approved, but no funds have been allocated for them, as there are projects suspended due to the deficit in the balance of payments and will have priority.

“The next budget will witness financial allocations to investment funds that support agriculture, industry and sustainable development in general, but debt repayment is not believed to have at least a share in the next budget,” he noted.

Earlier on Saturday, Oil Minister Ihsan Abdul-Jabbar set the price of a barrel in the 2022 budget, while he expected crude to reach $100.

The Minister of Oil said during a workshop held at Al-Rasheed Hotel and attended by the correspondent of the Iraqi News Agency (INA), that "the central government will fix the price of a barrel of oil in the 2022 budget between $55 and $60," noting that "this will help make changes and significantly improve performance of the national economy that exceeded the fiscal deficit in the general budget,”

Abdul-Jabbar expected, "The price of a barrel of crude oil will reach $100, in the first quarter of next year, affected by the decline in US and global strategic stocks and the recovery of the global economy from the repercussions of COVID-19,”

He announced that Schlumbinger will soon start a project to drill 96 oil wells in the West Qarna field 1, which is the largest of its kind in the country's history, noting that "the project will add 80,000 barrels per day as a first stage and 200 thousand barrels per day after its completion on the total production of Basra Oil Company, a subsidiary of the National Oil Company,”

"The Schlumpinger Company implemented for ExxonMobil, the main operator of the West Qarna field 1, by using modern technology in drilling operations in West Qarna 1, which helps all parties in the Ministry of Oil and licensing companies to reduce the costs of production per barrel and improve productivity,” he added.

The Minister of Oil expressed his optimism about a great development in the oil industry, especially that it has entered a new positive phase that competes with companies producing alternative solar energy and green and blue nitrogen fuels, noting that “giant companies have spent billions of dollars on establishing infrastructures to manufacture equipment, modern devices, batteries and other materials used in the alternative energy industry,”

For his part, Vice President of Schlumberger Saad Al-Damen said that, “Preparations are underway to launch drilling operations in the largest extractive project, which will be implemented according to the latest technology that will work on the project, and the preparation and installation of the information system and software rules for its management in the Basra Oil Company,”

China Says It 'Firmly Opposes' US Military Aid To Taiwan

- International

- 07:36

First joint picture of Greenland Ice Sheet melting, ESA

- Multimedia

- 09:28

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

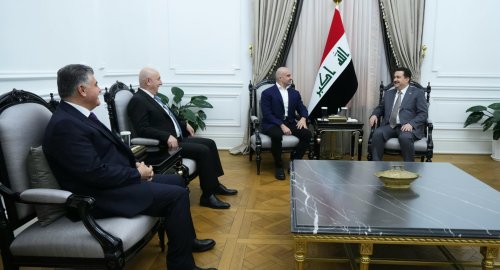

ISC, ADX discuss Strengthening Economic Ties

- Economy

- 24/12/16

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17