Objectives are determined to improve stock trading, says Iraq Stock Exchange

Economy

- 14-09-2022, 21:00

INA - BAGHDAD

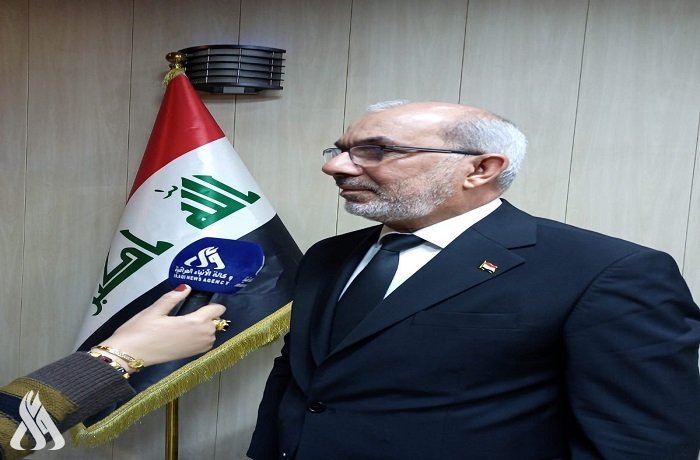

Iraq Stock Exchange identified on Wednesday, the most prominent objectives it seeks in order to improve the reality of stock trading in the shares of companies in the market, while summarizing its components and services.

"Iraq Stock Exchange market aims to organize and train its members and companies listed in the market,

as to promote the interests of investors in a free, honest, effective and competitive market characterized by transparency," said the Executive Director of the market, Taha Ahmed Abdul Salam to the Iraqi News Agency - INA.

He added, "In addition to that, regulating and simplifying securities transactions in fair, effective and regular financial transactions, including clearings and settlement processes for these transactions."

"One of Iraq Stock Exchange objectives is also to develop the capital market in Iraq to serve the national economy and help companies build the capital needed for investment, as well as educating Iraqi and non-Iraqi investors about investment opportunities in the market," he noted.

He pointed out that "the market aims to collect, analyze and publish statistics of necessary information to achieve the stated goals, as well as to communicate with stock markets in the Arab world and global markets aiming at improving the market, as to carry out other necessary services and activities to support its objectives."

Regarding the components of the capital market in Iraq, the Executive Director of the market explained, "Iraq Stock Exchange consists of 6 elements, represented by the Securities Commission and Iraq Stock Exchange, and the Iraqi joint stock companies whose shares are listed in the market."

"The other element is represented by securities brokerage firms licensed and authorized by the Securities Commission and the Association of Securities Brokers in Iraq, in addition to shareholders, investors and the custodian - to provide services to shareholders and investors. Finally, is the Clearing Bank - in charge of financial settlements via the Iraqi banking system," he included.

As for the services provided by Iraq StockExchange, Abdul-Salam said, "The Iraqi Stock Exchange has used the X-stream electronic trading system and the Equator central depository system from NASDAQ Technology since 2009."

"The trading mechanism derives its procedures from the instructions and rules of electronic trading for the Iraqi Stock Exchange that were issued in 2009," he noted.

He stressed, "The market applies disclosure instructions to joint stock companies and brokerage companies, instructions for control and solvency on brokerage companies in cooperation with the Securities Commission, and due diligence controls for securities dealers."

"The market uses specialized systems: the Back office - Brokerage firms system, the Shareholders - Listed Companies system, and the Anti-Money Laundering system when opening the accounts of new shareholders, as well as investors and future control over them," he explained.

He pointed out that "the market scrutinizes requests for listing and depositing shares of Iraqi joint stock companies, and submits them to the Board of Governors in accordance with the listing instructions, as well as monitoring and auditing the trading of brokerage companies, executed orders and stock prices in accordance with the instructions for trading in securities and the rules of electronic trading."

"The market provides the service of disclosing trading indicators daily, monthly and annually, in addition to disclosing the indicators of the annual and quarterly final accounts of listed joint stock companies that are accepted for listing in the market. The disclosure includes material extraordinary events and the decisions of the general bodies of joint stock companies," he highlighted.

Abdul-Salam indicated the dissemination of data to be via the Iraqi, Arab and international media, as well as the website of Iraq Stock Exchange www.isx-iq.net, the Depository Center www.idc-stocks.com, the market's website on YouTube, and the market page on the website of the Arab Federation of Exchanges www.arab-exchanges.org, in addition to the page of Iraq Stock Exchange on the website of the FEAS www.feas.org, "It is also published via an agency specialized in publishing Arab financial market data and analysis, in addition to the AMF database - Arab Financial Markets - Reports page."

"The market seeks to spread the culture of investment, attract investors and communicate with them via conferences, seminars and workshops inside and outside Iraq or at Baghdad International Fair, in the corridors of Iraqi universities and at the market headquarters, in addition to publishing introductory publications on market activity, trading indicators and investment mechanisms in securities through it," he included.

He noted the market's efforts to organize the presence of investors in the investor hall for free from 8:30am until 1:30pm to view and follow up on the daily trading of shares of joint stock companies, as well as organizing means of communication via Facebook by the Iraq Stock Exchange page and website. This is in addition to downloading the news and information of joint stock companies, invitations to meetings of their general bodies and decisions of these bodies free of charge, as well as answering the inquiries of society, shareholders and investors without exception, both in Arabic and English at a rate of no less than 12 hours a day.

"The market aims to provide Investors Relations services in the investor hall, direct inquiries, and publish the traded stock price ticker, trading analysis, volumes, and online daily for free from 10 am to 1 pm," he noted.

He added, "The market also organizes induction training workshops for investors and shareholders in person or through Zoom applications, in addition to training institutes and university students for at least 30 days for each training category, as well as a scientific workshop for students of institutes and universities at a rate of one day for each workshop."

Abdul-Salam concluded, "The market has participated in Arab and international federations as the training provides best performance practices and focuses on cooperation according to systematic plans that adopt international standards between the Iraqi Stock Exchange represented by the Board of Governors and the Securities Commission."

Prime Minister and Allawi discuss regional developments

- politics

- 09:15

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 08:53

Fire breaks out at Disney's Epcot theme park as huge plume of smoke rises over resort

- International

- 25/03/23