Stock Market in Iraq: A platform for trading shares of undisclosed joint-stock companies

- 29-06-2022, 22:00

INA – BAGHDAD

Stock Market in Iraq announced on Wednesday, launching a platform for trading shares of undisclosed joint stock companies.

"It was decided to develop and launch a platform for trading shares of undisclosed joint-stock companies, starting from the session of next Sunday, July 3rd," said the Executive Director of the market, Ahmed Abdel Salam in a statement received by the Iraqi News Agency – INA.

He noted that, "this came in accordance with Legislative Order No. 74 of 2004, the instructions and rules issued by the Securities Commission and the Iraq Stock Exchange.”

"The platform aims to protect the rights of shareholders in joint stock companies listed on the Iraq Stock Exchange, attract potential investors, and activate trading in securities. The rate of change in the session will be 5%, up and down from the previous closing price of the stock, as the price will be left by 50% change from the last closing price of the stock in the first trading session on the platform,” he explained.

He stated that "trading on this platform will take place for companies that the Securities Commission had previously decided to suspend from trading because they did not provide the required disclosures, which are Electronic Industries Company, Light Industries Company, Al Badia Public Transport Company, Modern Construction Materials Industry Company, and the Iraqi Transport Company, Babel Bank Company, Al Batik Financial Investments Company, Modern Animal Production Company, Al Shamal Bank Company, Al Khair Financial Investment Company and the Iraqi Company for the Transport of Oil Products.”

“The authority is the one who decides in the future to include any company in trading on this platform," he pointed out, calling "the aforementioned companies to commit to providing the minimum disclosure of a report on the company's status from the date of submitting the last financial statements to date, lawsuits, seizure and mortgage, any events and material impact on the company's activity.”

He indicated that "the experience and mechanisms will be evaluated after three months from the start of the application and benefit from the observations indicated on it according to an evaluation and efficiency assessment form," explaining that "the Securities and Exchange Commission and the Iraq Stock Exchange decided to increase the price change rate from 10% to 15% starting from July, 3rd 2022, for the companies listed therein, in order to activate trading on the regular trading platform.”

“Based on the principles of the work of the securities commissions and stock exchanges and the principles of the International Federation of Authorities, we stress that the potential shareholder and investor - the responsibility of buying and selling shares on the shares listed on the undisclosed companies platform - based on his investment decisions,” he indicated.

Salam included that, “and the brokerage companies highlight a note in the authorization to buy and sell and in the investor agreement includes the phrase informing the shareholder and investor of the above and acknowledging that he bears any risks that may appear later due to lack of information, data and lack of disclosure for the companies participating in this platform.”

France: Europe will respond proportionately to tariffs

- Economy

- 09:19

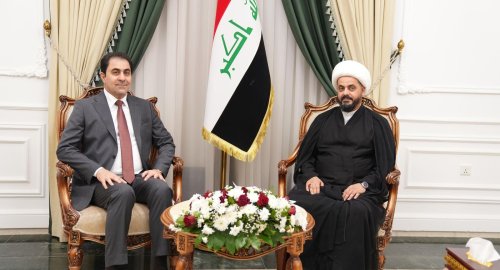

Al-Mandalawi Meets Sheikh Al-Khazali

- politics

- 08:59

Gaza Health Ministry Announces New Death Toll for Zionist Aggression

- International

- 06:04

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01