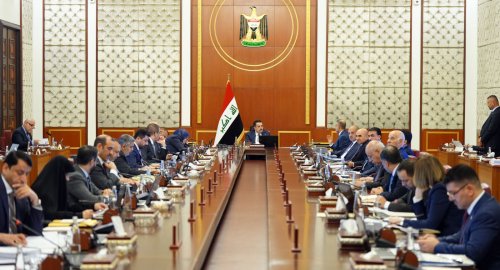

The Cabinet held the 4th regular session, decisions included

- 28-01-2025, 21:05

INA - BAGHDAD

The Cabinet held the 4th session of the current year chaired by PM Muhammed S. Al-Sudani as decisions and recommendations were issued.

The session included discussions on the general situation in the country, important files, and priorities for implementing the government program, as well as deliberations on agenda items and necessary decisions, according to a statement by the PM's Media Office - received by the Iraqi News Agency - INA.

In the energy sector, the Cabinet approved including the Majnoon Oil Field in social benefit projects, aligning it with existing licensing contracts.

The Ministry of Oil/Basra Oil Company is authorized to implement service projects under Cabinet Decision No. 24318 of 2024 regarding social benefits. The Ministry of Finance will allocate $10 million annually from the Majnoon Oil Field account for these projects within the operating budget of the field operator, Basra Oil Company.

For airport development and management, the Cabinet approved the following:

1. Allowing the Ministry of Transportation to contract the International Finance Corporation (IFC) to prepare investment proposals for managing, operating, and developing the Basra, Mosul, Dhi Qar, and Najaf airports through public-private partnerships (PPP). The consultancy costs will be charged to the winning bidder and partially to the respective provinces.

2. The Ministry of Transportation or the province where the airport is located will handle contracting with the private partner, coordinating with both entities.

3. The Ministry of Transportation will oversee airport revenues, operations, and employment in coordination with the provinces, which will act as the liaison with the federal government.

4. Federal authorities will retain responsibility for passports, customs, health, airport security, air traffic control, and quality control.

5. Baghdad International Airport is excluded from these provisions, with the Ministry of Transportation maintaining exclusive contracting authority.

Additionally, the Cabinet approved:

1. Iraqi Airways to settle fees after signing investment or partnership contracts per the Civil Airport Fee System (No. 6 of 2018).

2. Authorizing the Ministry of Transportation to negotiate with investors or partners regarding minimum airport revenues and presenting negotiation reports to the Cabinet for financial guarantees.

3. Including a clause in contracts stipulating compensation terms in case the government or airport management unilaterally terminates the contract before its expiration.

4. The Ministry of Transportation, Civil Aviation Authority, and the PMAC have prepared a draft amendment to the Airport Fee System No. 6 of 2018. This amendment aims to address the issue of fees collected under the system, ensuring alignment with the nature of contracts and the economics of the air transport market.

In financial reforms, the Cabinet approved drafting a bill to link the operations of the Insurance Bureau to the Central Bank of Iraq. As a non-banking financial institution, the bureau is tasked with regulating and overseeing the insurance sector to foster an open, transparent, and financially secure market.

For tax cooperation, the Cabinet authorized the Director General of the General Commission for Taxes in the Ministry of Finance to negotiate and initial a draft agreement to avoid double taxation and prevent tax evasion on income and capital between Iraq and Oman. The Ministry of Foreign Affairs will prepare the necessary authorization documents for the Director General and forward them to the General Secretariat of the Cabinet for the Prime Minister's signature.

To promote trade and streamline processes, the Cabinet approved the draft statute for regulating e-commerce in Iraq.

The Cabinet also approved the first amendment to the Sunni Endowment Diwan Law (No. 56 of 2012), as reviewed by the State Council, and referred it to Parliament, incorporating the Legal Department’s observations.

Developing Baghdad’s heritage areas, the Cabinet approved exempting the Qushla Heritage Building Rehabilitation Project (Al-Aqsa Post Office) from Government Contract Execution Instructions (No. 2 of 2014) and contracting with the company nominated by the Ministry of Culture, Tourism, and Antiquities.

In terms of addressing stalled and delayed projects, the Cabinet approved the following:

1. Adding a component for medical equipment, furniture, and supplies to the Mosul Hospital Rehabilitation Project, listed in the 2023 investment budget for the Ministry of Health, under a new contract. The project’s total cost will also be increased.

2. Increasing the contingency and total cost for the Residential Complex Project in Diyala Governorate/Al-Ghalibiyah and raising supervision and monitoring allocations.

3. Increasing the contingency and total cost for the Residential Complex Project in Wasit Governorate/Zurbatiyah.

4. Increasing the contingency for classroom construction in the Engineering Complex project at the University of Babylon, adding a component for unpaid dues related to classroom construction, and increasing the total project cost.

As part of the government's efforts to provide support for the parliamentary elections, the Cabinet approved the inclusion of the difference amounting to 294.370 billion Iraqi dinars in the tables of estimates for the 2025 Federal Budget. This decision is based on the provisions of the Federal Budget Law (No. 13 of 2023), bringing the total amount to 398.600 billion Iraqi dinars. The purpose is to cover the costs of conducting the 2025 parliamentary elections, exempting the process from the instructions for implementing government contracts (No. 2 of 2014) and the instructions facilitating the implementation of the Budget Law (No. 1 of 2023).

Additionally, it included the amendment to the Budget Law for the years 2023, 2024, and 2025 including sovereign expenses for the parliamentary elections.

Trump: During our call, I heard Zelensky's desire for peace

- International

- 09:25

Al-Azhar: Proposals to displace the Palestinian people are not applicable

- International

- 09:18

Putin invites Trump to visit Moscow

- International

- 08:07

Trump: I agreed with Putin to stop the war between Russia and Ukraine

- International

- 08:06

Iraqi Tour, a journey to break barriers, paint a new image of the country

- Sport/Investigations and reports

- 25/02/10

Iraq, Morocco discuss regional issues, and challenges facing the region

- politics

- 25/02/08