Oil prices jump on major crude inventory draw

- 24-08-2022, 20:34

INA – SOURCES

Crude oil futures Wednesday were slightly higher, consolidating the week-long rally, which was revitalized Monday after comments from Saudi Arabia that it would consider production cuts due to what it said was a disconnect between futures and fundamentals.

Markets shrugged off various reports that an Iranian nuclear deal was getting closer, with US diplomats briefing there are still a number of hurdles.

Front-month October ICE Brent futures were trading at $100.67/barrel (1510 GMT), compared to Tuesday’s settle of $100.22/b, although off from Wednesday's earlier high of $101.90/b.

At the same time October NYMEX WTI was trading $94.41/b, versus Tuesday’s settle of $93.74/b.

Prices briefly dipped into negative territory after the Energy Information Administration reported US crude stocks last week dropped 3.3 million barrels, failing to match the steeper drop reported by the API. The EIA also said gasoline inventories were unchanged and distillates down 700,000 bpd.

The American Petroleum Institute reported late Tuesday that US commercial crude inventories fell by 5.6 million barrels last week, a figure above most expectations. Gasoline stocks posted a small build of 268,000 barrels and distillate inventories increased by 1.05 million barrels.

Oil was positive for much of the session, with comments from Saudi Arabia seemingly putting a floor under the market.

Aoun: Lebanon must change its political and economic performance

- International

- 04:47

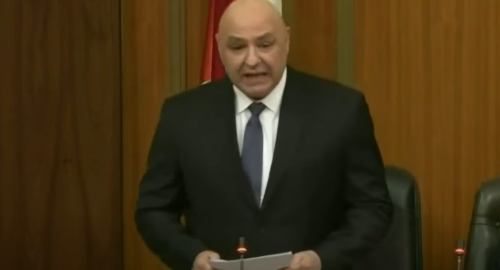

Joseph Aoun as President of Lebanon

- International

- 04:45

US, Arab Mediators Make Some Progress in Gaza Peace Talks, No Deal Yet

- International

- 02:25

China battling flu surge, say doctors

- International

- 02:10