PM advisor: An enactment of a law to encourage Iraqi expatriate capitals return

Economy

- 2-05-2022, 21:07

INA - BAGHDAD

The financial advisor to the Prime Minister, Mudhher Muhammad Salih, confirmed on Monday, that the phenomenon of Iraqi capitals leaving returns back to the fifties of the last century.

"The phenomenon of Iraqi capitals leaving and its settlement in its investment strongholds outside Iraq came according to a long history that returns back to the fifties of the last century, and the leakage of funds was done in invisible ways by inflating the values of imports through bank credits for wealthy importers but on a very small scale," said Salih to the Iraqi News Agency - INA.

He added, "The situation has continued by various illegal means over the years, political conditions, crises, long wars and economic siege, as Iraqi law historically did not allow Iraqi private sector investment abroad at all, which encouraged the phenomenon of flight,".

"Due to the abolition of restrictions on external transfer under the Central Bank of Iraq Law No. 56 of 2004 and the liberalization of the current account of the balance of payments in particular, economic freedom after 2003 allowed the leakage of a lot of money to invest outside the country with wide freedom and settlement in environments that may be of low return but high relative safety, without the availability of sufficient and explicit legal texts that prevent the leakage of capital outside the country or the existence of explicit texts that allow the exit of national capital for the purpose of investing outside the country, especially after this was permitted by Article (28/b) of the Central Bank of Iraq Law No. 56 of 2004 which stipulated: (the simple unconditional purchase or sale (cash or forward) of foreign exchange)," he included.

He explained, "Thus, those funds that left the country without legal prosecutions are considered national (expatriate) capital whose proceeds have been invested in various aspects of investment in assets outside the country and for different years and enjoy the legal status in their foreign investment sites as they are subject to the controls and conditions of the jurisdiction and legal area in countries of foreign domicile, but unfortunately it is a cut off from its home country Iraq, and it is excluded from the funds that the Iraqi state is currently pursuing based on the provisions of the Iraqi Funds Recovery Fund Law No. 7 of 2019 amending Law No. 9 of 2012 on looting public money, as well as with the exception of funds that are subject to the Anti-Money Laundering Law Crime and Terrorism Money No. 39 of 2015,".

Salih pointed out that "in order to return Iraqi expatriate investments abroad, it is appropriate to issue legislation or law that encourages the return of Iraqi capital expatriates inward to find their way in the investment map in Iraq and the advancement of our country's development, provided that it provides full legal protection for them and enjoys the same privileges that gets the foreign investor via the Investment Law, as well as the enjoyment of all legal rights," noting that" Iraq is perspective under the International Convention for the Protection of Foreign Investments, specifically Multilateral Investment Guarantee Agency ‐ MIGA, which is one of the agencies affiliated with the World Bank Group,".

"There is a necessity to have a semi-official entity, starting to represent the (Investment Council for Iraqi Expatriates) to establish the best links with expatriate Iraqis to invest their money in their country, Iraq, whether real or financial investment, which will be allowed by the expatriate Iraqi capital investment law that we propose to be issued," he noted.

La Liga continues to pressure Barcelona

- Sport

- 09:47

Zionist airstrikes target the Damascus countryside

- International

- 09:07

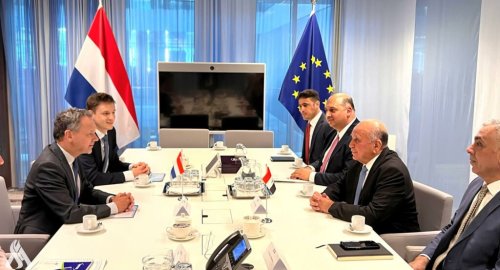

Foreign Minister Invites Dutch Counterpart to Visit Iraq

- politics

- 06:38

Iraq Condemns Zionist Airstrikes on Syria

- politics

- 06:36

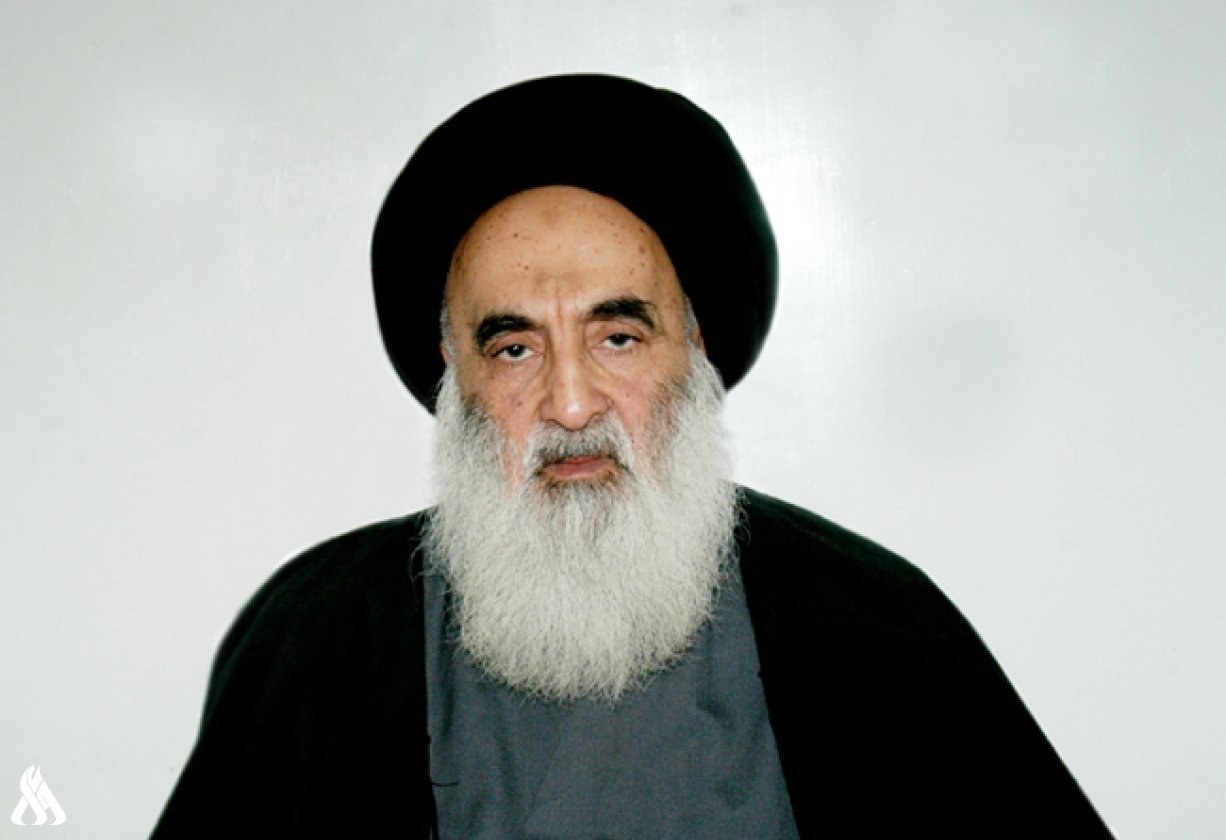

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01