Oil Approaches $90 on Firm Demand, Ukraine Invasion Fears

- 27-01-2022, 10:53

INA-sources

Oil rose early on Wednesday to the highest level since 2014, with Brent approaching $90 a barrel, as resilient global demand despite the Omicron wave and fears of a Russian invasion of Ukraine supported prices.

As of 9:24 a.m. EST on Wednesday, before the weekly U.S. inventory report from the EIA, WTI Crude prices were up 1.07% at $86.52, and Brent Crude was less than a dollar below $90—at $89.35, up 1.30% on the day.

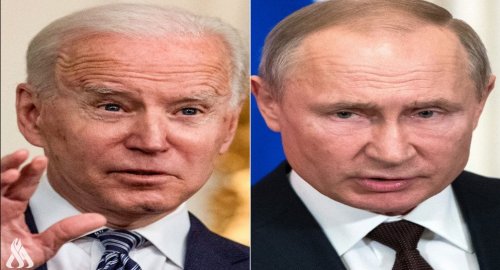

Prices rose as the tension between the West and Russia over Ukraine continues.

On Tuesday, U.S. President Joe Biden said, commenting on the Russia-Ukraine crisis: “I have made it clear to — early on to President Putin that if he were to move into Ukraine, that there’d be severe consequences, including significant economic sanctions, as well as I’d feel obliged to beef up our presence — NATO’s presence in — on the eastern front: Poland, Romania, et cetera.”

Fears of disruption of energy supply from Russia, a major exporter of oil and natural gas, especially to energy-crisis-stricken Europe, have rattled the commodity markets in recent days.

On Tuesday, the American Petroleum Institute (API) estimated the inventory draw this week for crude oil to be 872,000 barrels after analysts predicted a draw of 400,000 barrels.

“Last night the American Petroleum Institute reported a 0.9-million-barrel drop in US crude inventories, and the continued tightness can be seen in time spreads which continue to widen, especially in WTI where the March-April spread trades at a very elevated $1.2 per barrel,” Saxo Bank said in a daily market commentary on Wednesday morning.

In another bullish development for oil prices, more Chinese are expected to travel for the Lunar New Year holiday this year than in the previous two years, despite the Omicron spread, in a boost to fuel consumption in the world’s largest crude oil importer, according to data cited by Bloomberg.

Source: Oilprice.com

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17

Hackers exploiting Microsoft Teams to gain remote access to user’s system

- Multimedia

- 24/12/17