Oil prices hits highest levels in years amid Covid-19 recovery

- 18-10-2021, 08:56

INA-sources

Brent crude oil futures rise to 2018 levels as US West Texas Intermediate crude futures revisit 2014 peaks

Oil prices hit their highest in years on Monday as demand continues its recovery from the Covid-19 pandemic, boosted by more custom from power generators turning away from expensive gas and coal to fuel oil and diesel.

Brent crude oil futures rose 87c, or 1%, to $85.73 a barrel by 3.11am, the highest price since October 2018.

US West Texas Intermediate (WTI) crude futures climbed $1.12, or 1.4%, to $83.40 a barrel, highest since October 2014.

Both contracts rose by at least 3% last week.

“Easing restrictions around the world are likely to help the recovery in fuel consumption,” analysts from ANZ bank said in a note on Monday.

“The jet fuel market was buoyed by news that the US will open its borders to vaccinated foreign travellers next month. Similar moves in Australia and across Asia followed.”

They added that gas-to-oil switching for power generation alone could boost demand by as much as 450,000 barrels per day in the fourth quarter.

Still, supply could also increase from the US, where energy firms last week added oil and natural gas rigs for a sixth consecutive week as soaring crude prices prompted drillers to return to the well pad.

The US oil and gas rig count, an early indicator of future output, rose 10 to 543 in the week to October 15, its highest since April 2020, energy services firm Baker Hughes Co said last week.

China’s economy, meanwhile, is likely to have grown at the slowest pace in a year in the third quarter, hurt by power shortages, supply bottlenecks and sporadic Covid-19 outbreaks.

The world’s second-largest oil consumer issued a new batch of oil import quotas for independent refiners for 2021 that show total annual allowances were lower than last year, a first reduction of import permits since these firms were allowed into the market in 2015.

Source: Reuters

Al-Maliki: Iraq Managed the Electoral Process Smoothly

- politics

- 05:18

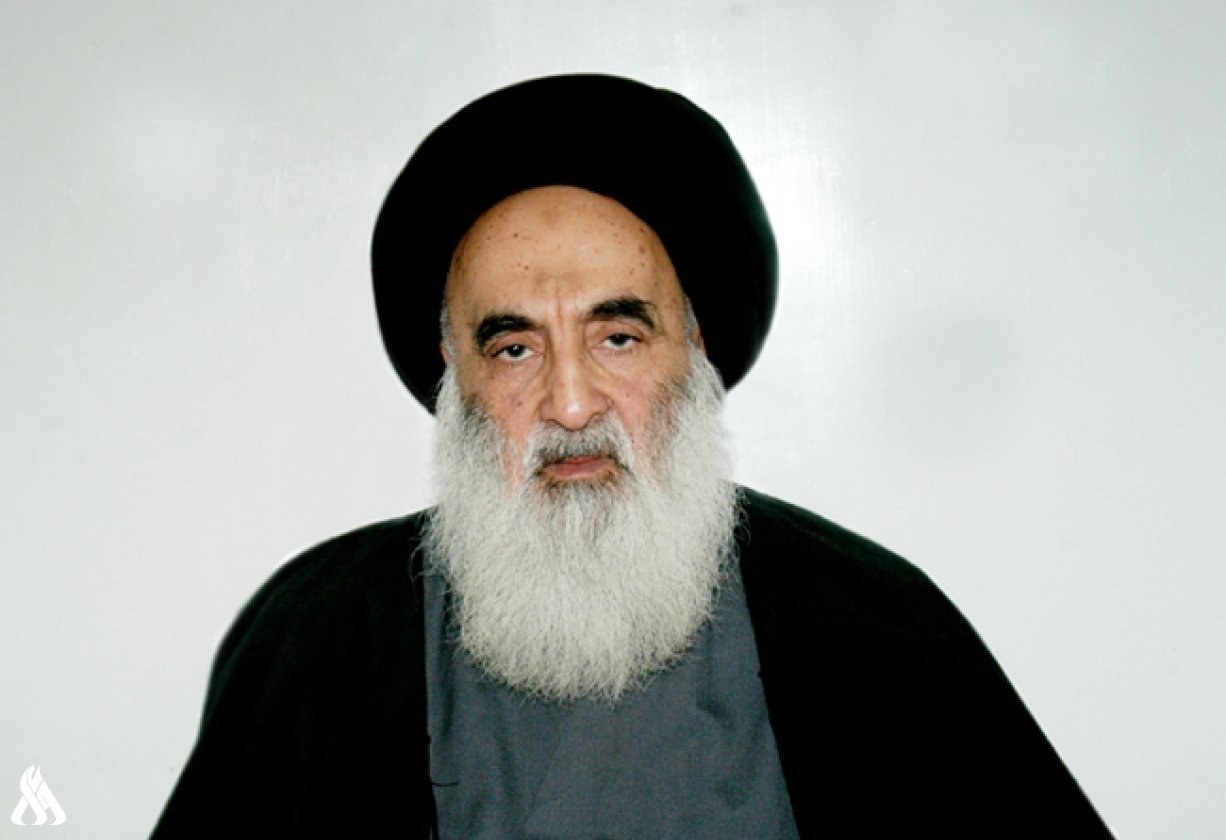

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

Al-Amiri warns of any war between Iran and the US

- politics

- 25/04/01