CBI Governor announces integration of Iraq's e-payment system with global networks

- 26-02-2025, 13:07

INA- BAGHDAD

The Governor of the Central Bank of Iraq, Ali Al-Alaq, announced on Wednesday the details of electronic payment in all of Iraq, he pointed out that the financial inclusion rate has increased to more than 40 percent, he emphasized that the bank has achieved international integration by linking the Iraqi electronic payment system to global networks

Al-Alaq said in a speech during the ninth annual exhibition and conference for finance and banking services in Iraq, which was attended by a reporter of the Iraqi News Agency (INA): “There is a complete roadmap for the digitization of banking services through electronic payment as a key tool for digital transformation, as the number of devices reached 63 thousand devices in the governorates of Iraq.”

“The number of ATMs has reached more than 4,000 devices and the number of bank cards is about 17 million,” he added.

“The Central Bank supported the licensing and operation of mobile e-wallets that allow charging, transferring and paying bills, which raised the rate of financial inclusion to more than 40% compared to 20% three years ago,” he said.

“The number of permanent wallets has reached one million and 200 thousand wallets, and we have achieved international integration by linking the Iraqi electronic payment system to global payment networks, allowing the transformation of the acceptance of foreign cards locally and expanding the acceptance of Iraqi cards internationally,” he said.

“The achievements in the field of information technology and electronic payments at the Central Bank are a fundamental shift in the financial system,” he said.

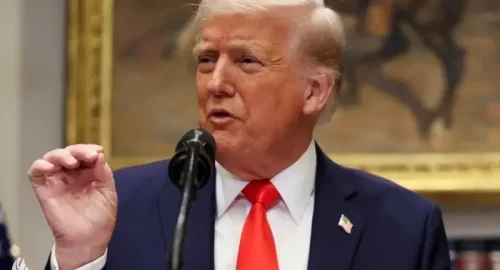

Trump: US and Iranian officials in talks

- International

- 05:31

ChatGPT temporarily down due to pressure from cartoon trend

- Articles

- 05:16

Prime Minister Arrives in Maysan Governorate

- Local

- 04:26

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

SOMO: Iraq has the fourth-largest proven oil reserves in the world

- Economy

- 25/03/26