Gold prices stabilize with anticipation of US inflation data

- 28-03-2024, 20:35

Follow-up - INA

Gold prices stabilized globally today, Thursday, with anticipation of the announcement of US inflation data, with investors absorbing the comments of Federal Reserve Governor Christopher Waller regarding lowering interest rates and anticipating more US economic data to measure the course of monetary policy.

By 05:03 GMT, gold in spot transactions rose 0.1 percent to $2,195.59 per ounce, and US gold futures rose 0.2 percent to $2,195.10.

“The US Federal Reserve has indicated its desire to lower interest rates, and there are concerns about geopolitical risks that are still affecting the markets related to wars, whether in Ukraine or in the Middle East, which supports gold,” said Ilya Spivak, head of global macroeconomics at Tasty Life.

He added, "Gold prices are trading in a limited range most of the time this month, and exceeding the level of $2,225 per ounce may push prices towards the level of $2,300."

Gold hit a record high last week after the US Central Bank expected to cut interest rates three times this year despite the recent high inflation readings.

Waller said on Wednesday that the disappointing recent inflation data confirms the necessity of refraining from reducing the target interest rate in the short term.

Investors are now awaiting the US core personal consumption expenditures price index report scheduled for Friday to calculate the timing of interest rate cuts.

The personal consumption expenditures price index is expected to rise 0.3 percent in February, which will maintain the annual pace of 2.8 percent. Investors are also awaiting the weekly report on unemployment claims in the United States, which will be released later on Thursday.

Traders currently expect 62 percent that the Federal Reserve will begin cutting interest rates in June, according to CME Group's Fed Watch tool.

Low interest rates reduce the opportunity cost of holding bullion.

As for other precious metals, silver in spot transactions reached $24.68 per ounce. Platinum rose 0.7 percent to $899.75, and palladium rose 1.4 percent to $997.41.

PM Al-Sudani arrives in Nineveh

- politics

- 10:17

China Says It 'Firmly Opposes' US Military Aid To Taiwan

- International

- 07:36

First joint picture of Greenland Ice Sheet melting, ESA

- Multimedia

- 09:28

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

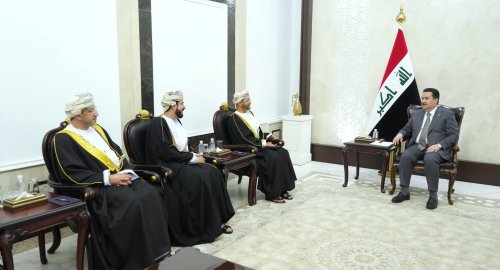

ISC, ADX discuss Strengthening Economic Ties

- Economy

- 24/12/16

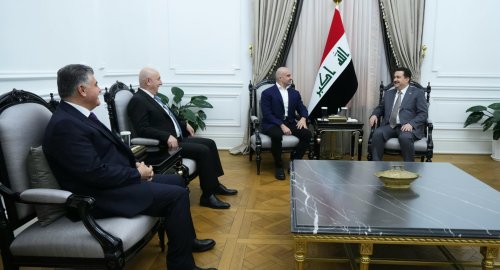

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17