Oil mixed as investors weigh China demand and U.S. outlook

- 24-01-2023, 09:15

INA-sources

Crude oil prices edged higher in Asian trade on Tuesday amid hopes of a fuel demand recovery from top importer China, although concerns about a slowdown in the U.S. economy capped gains.

Brent crude was down 5 cents to $88.14 per barrel by 0436 GMT after rising to a session high of $88.36. U.S. West Texas Intermediate (WTI) crude rose 2 cents to $81.64 per barrel after climbing to $81.88 earlier in the session.

Commodities like crude oil, refined petroleum products, LNG, and soybeans are set to benefit from China's demand tailwind, analysts at Goldman Sachs said.

Crude oil prices in physical markets have started the year with a rally, as China, no longer held back by pandemic controls, has shown signs of more buying and as traders have worried that sanctions on Russia could tighten supply.

"Besides, the greenback hovering around a multi-month low is buttressing oil prices," independent oil market expert Sugandha Sachdeva said.

The dollar hovered near a nine-month low to the euro and gave back recent gains against the yen, as traders continued to gauge the risks of a U.S. recession and the path for Federal Reserve policy.

A weaker greenback makes dollar-denominated commodities, including oil, cheaper for buyers using other currencies.

In the United States, "the economy still could rollover and some energy traders are still sceptical on how quickly China's crude demand will bounce back this quarter," OANDA analyst Edward Moya said in a note.

Source: Reuters

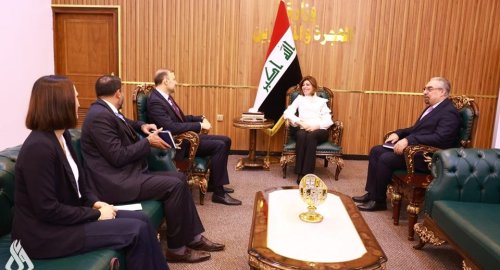

Presidencies hold meeting at Baghdad Palace

- politics

- 06:59

WHO: Increase in flu cases in China within expected range

- International

- 06:27

Turkish FM reveals international consensus on 4 items related to Syria

- International

- 05:49

Central London evacuated after bomb threat

- International

- 05:46

- Sport

- 25/01/02