Finance Minister: Unstudied changing in currency exchange leads to financial chaos

- 28-02-2022, 19:10

INA - LIVE UPDATES

Iraqi Minister of Finance explained on Monday, that reconsidering the exchange rate of the currency in an unstudied manner leads to financial chaos similar to some countries.

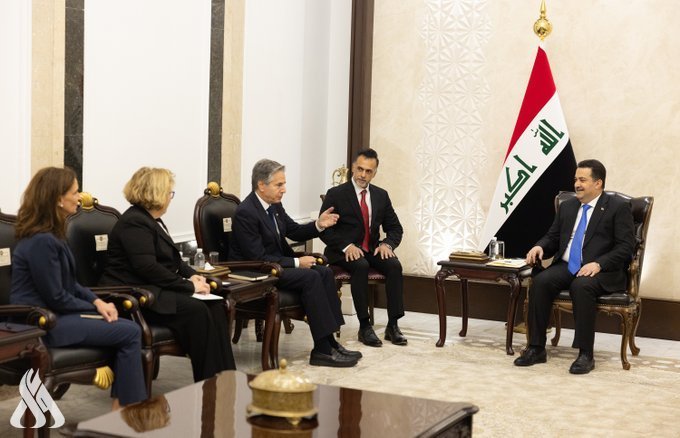

The Parliament hosted the Minister of Finance, Ali Abdul-Amir Allawi during the second session of the 5th electoral cycle for the 1st legislative year of its 1st term, where 288 MPs attended to discuss the dollar exchange rate and its repercussions on the local market, according to a statement by the Media Department of the Parliament, received by the Iraqi News Agency – INA.

During the session, the rise in the dollar exchange rate and its repercussions on the market were discussed including the high prices rise and the damage to the poor segment, as well as the public debt and the financial policy of the Ministry of Finance and the proposed treatments.

The statement included that Allawi reviewed, in a detailed explanation, the reasons for changing the exchange rate relating it to economic reform, which was according to an extensive study in which concerned parties participated as it ‘was not’ an individual decision by the Ministry of Finance.

The minister indicated that “the change in the exchange rate at that time was against the background of the deterioration in global oil prices due to the impact of Corona pandemic and a decline in the volume of Iraqi oil exports, as an estimate of the International Monetary Fund amounted to (4.9%), in addition to the failure to approve the 2020 budget due to the resignation of the government, which led to a financial crisis,”

He added, saying “A suffocating situation that prevented the payment of the salaries of employees and retirees, which prompted the Parliament to pass a law to finance the deficit in the amount of 27 trillion dinars,” noting that “2021 budget was developed according to reforming plans contributed to developing solutions, addressing the financial situation and working to develop the long-term financial strategy by presenting the White Paper that restored balance to the Iraqi economy, provided economic stability for people with limited incomes, and corrected local investment,”

“The imbalance in the Iraqi economy is due to the negatives accumulation as well as the direct and indirect state control over the economy since the seventies of the last century," he noted, adding “Reconsidering the exchange rate of the currency in an unstudied manner leads to financial chaos similar to some countries, so the trend was to determine the price of exchanging the Iraqi dinar comfortably to protect it from any foreign changes in a proactive and correct step in coordination with the Central Bank and studying it with the Prime Minister, heads of political blocs and other parties, in addition to the support of the International Monetary Fund regarding changing the price at a reasonable rate,”

Allawi explained that "the benefits of devaluing the Iraqi dinar increased government revenues by 23%, including maximizing the funds allocated to finance reconstruction projects and allowing the government to respond to the increase in citizens' needs and contribute to strengthening the balance of payments for the country and avoiding risks, as well as the International Monetary Fund's support for the reduction process being the financial situation of Iraq, especially the competitiveness of the private sector, will strengthen against cheap foreign imports, and foreign investments will be revived as a direct result of the development of the financial and economic situation, which is witnessing a recovery and stability of markets,”

He pointed out that "the rise in prices in the Iraqi markets was not only due to the decrease in the exchange rate of the dollar, but rather as a result of the increase in global food prices since 2020," mentioning that "the rise in global oil prices is beneficial for Iraq and at the same time affects its needs of foodstuffs, oil derivatives and gas imports which is used to generate electricity by 30%, alluding to the reduction of the Iraqi external debt by $4 billion in 2021,”

“There is a global imbalance in the economy and a defect in the commercial, import and institutional situation in Iraq, especially the uncontrolled ports, as well as the poor absorption of the agricultural, industrial and private sectors of the economic changes taking place in the world," he responded to a question by one of the Parliament MPs, noting that "the rate of payment of farmers' dues amounted to 65% with many backlogs for 2019 and 2020 as the financial crisis that occurred in 2021 affected the possibility of implementing some of the provisions contained in the budget law,”

Within the same context, the Speaker of the Iraqi Parliament called on the Ministry of Finance to work on presenting a new vision to address the negative effects that resulted in changing the exchange rate, to be presented to the Parliament within two weeks.

In turn, the Minister of Finance explained that "it is not possible at the present time to change the exchange rate because it has achieved stability in the Iraqi economy and its change is linked to the rise in financial abundance that meets the ambition,”

Sweden Will No Longer Fund UNRWA Aid Agency

- International

- 02:10

Seven dead, dozens injured in India tanker blast

- International

- 02:00

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

Transport Ministry records an earthquake in Salah al-Din

- Local

- 24/12/13