PM Advisor announces Launch of 70 Banking Products to Promote Development and Financial Inclusion

- 25-02-2025, 13:08

Baghdad-INA

The Prime Minister's Advisor for Economic Affairs, Abdul Hussein Al-Anbaki, announced today, Tuesday, the launch of 70 new Islamic banking products.

Al-Anbaky told the Iraqi News Agency (INA) that "the Sharia Standards Committee for Islamic Banks continues to review more standards to ensure their compliance with national regulations, within the framework of cooperation with the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)," noting that "the Sharia standards set by the organization are adopted in 37 regulatory bodies across 26 countries as a basis for formulating local regulations and are not mandatory."

He added that "the new banking products represent a qualitative shift in the banking sector, and will contribute to attracting savings, stimulating development financing, and reducing the phenomenon of hoarding, which negatively affects the Iraqi economy, with 73% of the money supply remaining outside banks."

He explained that "these products provide banking solutions that are compatible with Sharia controls, which enhances customer confidence in Islamic banks, and pushes towards expanding financial inclusion and raising the credit rating of Iraqi Islamic banks. It will also allow a large segment of society to return to banking transactions, after having been deprived of them due to the absence of products compatible with Islamic Sharia."

Al-Anbaki called on "the Central Bank to support these products and integrate them into monetary policies, to ensure their positive impact in enhancing financial stability, stimulating the supply of money and demand for it, and increasing the doubling of credit," stressing that "this step will enable Iraq to benefit from global experiences in Islamic banking systems, which will contribute to achieving comprehensive economic development."

- Economy

- 06:23

Myanmar powerful earthquake death toll reaches 2000

- International

- 04:14

PM: Maysan will be an oil and industrial city

- politics

- 04:10

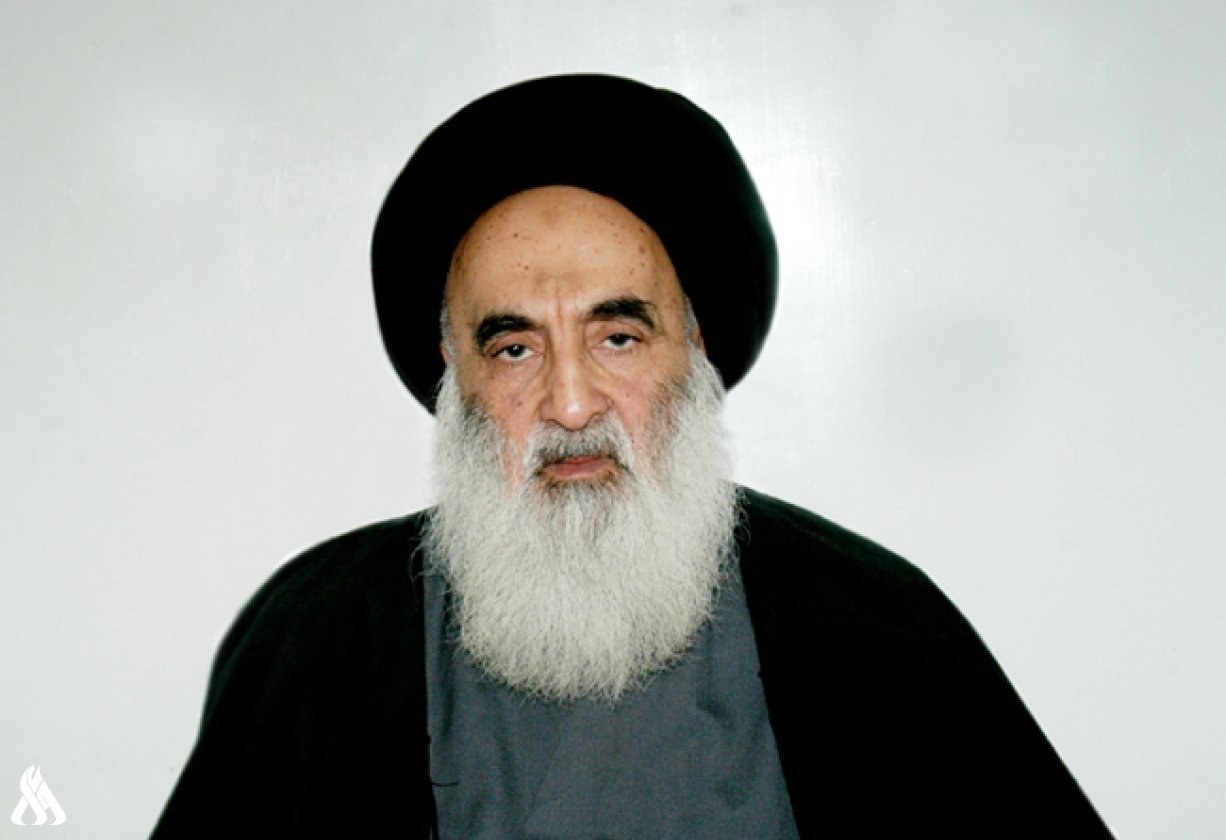

Al-Sistani: Tomorrow, the 29th of Ramadan

- Local

- 25/03/29

SOMO: Iraq has the fourth-largest proven oil reserves in the world

- Economy

- 25/03/26