Oil rises settles higher; US inflation data feeds rate cut hopes

International

- 12-07-2024, 09:00

INA- SOURCES

Oil prices rose for the second consecutive session on Thursday with the Brent benchmark settling above $85 a barrel as hopes rose for U.S. interest rate cuts after data showed an unexpected slowdown in inflation.

Brent crude futures rose 32 cents, or 0.4%, to settle at $85.40 a barrel. U.S. West Texas Intermediate crude futures rose 52 cents, or 0.6%, to $82.62 a barrel.

Data showed U.S. consumer prices fell in June, stoking hopes the Federal Reserve will cut rates soon. After the data, traders priced an 89% probability of a rate cut in September, up from 73% on Wednesday.

Slowing inflation and interest rate cuts will likely spur more economic activity, Growmark Energy analysts said.

Fed Chair Jerome Powell acknowledged the recent improving trend in price pressures, but told lawmakers more data was needed to strengthen the case for rate cuts.

The data pulled the U.S. dollar index lower and that should support oil prices, said Gary Cunningham, director of market research at Tradition Energy. A softer greenback can lift demand for dollar-denominated oil from buyers using other currencies.

Prices also rose on Wednesday, snapping a three-day losing streak after U.S. data showed a draw in crude stocks in the world's top oil market along with declining inventories and strong demand for gasoline and jet fuel.

Front-month U.S. crude futures recorded their steepest premium to the next-month contract since April. Market participants' willingness to pay premiums for earlier delivery dates, a structure known as backwardation, is typically a sign of supply tightness.

Some still believe the oil demand outlook is tenuous. In its monthly oil market report, the International Energy Agency (IEA) saw global demand growth slowing to under a million barrels a day this year and next, mainly reflecting a contraction in China's consumption.

Still, producer group OPEC in its monthly report on Wednesday kept forecasts for world demand growth unchanged, at 2.25 million for this year and 1.85 million bpd next year.

"OPEC and the IEA demand forecast are wider apart than usual, partly due to the differences of opinion over the pace of the world's transition to clear fuels," StoneX analyst Alex Hodes said.

SOURCE: REUTERS

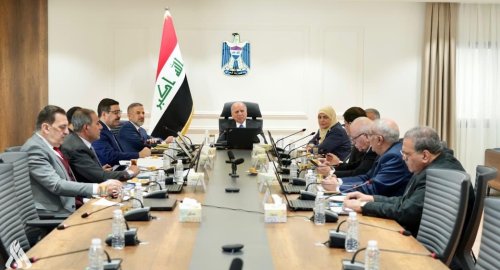

PM Al-Sudani chairs a special meeting on energy projects

- politics

- 07:58

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17

Hackers exploiting Microsoft Teams to gain remote access to user’s system

- Multimedia

- 24/12/17