Oil falls on concerns of weaker demand forecasts, slowing U.S. economy

- 4-07-2024, 11:13

INA- sources

Oil prices fell in Asia on Thursday, with investors turning cautious on expectations of lower demand as U.S. employment and business data came in weaker than forecast, signalling the economy of the world's top oil consumer may be cooling.

Brent crude futures were down 48 cents, or 0.55%, at $86.86 a barrel, while U.S. West Texas Intermediate (WTI) crude futures fell 51 cents, or 0.62%, to $83.36 by 0342 GMT, with activity thinned by the U.S. Independence Day holiday.

"Geopolitics and weather remain bullish risks, but the underlying physical market strength looks set to turn softer," said Citi analysts in a client note, adding that physical markets are trading post-summer September cargoes when demand could soften partly due to hurricane risks.

U.S. crude shipments bound for Europe fell to a two-year low in June as European buyers bought cheaper regional and West African oil, though some rebound in purchases in July and August could still happen.

Underscoring the lower demand expectations was data in the United States on Wednesday that showed first-time applications for U.S. unemployment benefits increased last week, while the number of people on jobless rolls rose further to a 2-1/2-year high towards the end of June.

Separately, the ADP Employment report showed private payrolls increased by 150,000 jobs in June, below a consensus predicting an increase of 160,000, and after rising by 157,000 in May.

In a further sign of a loss of momentum in the economy, the ISM Non-Manufacturing index, a measure of U.S. services sector activity, fell to a four-year low of 48.8 in June, well below the 52.5 consensus, amid a sharp drop in orders.

However, weaker economic data may add to the Federal Reserve's arguments to start cutting rates, analysts said, a move that would be supportive for the oil markets as lower rates could boost demand.

"The direction of recent data conforms to the Fed's easing bias," ANZ Research analysts said in a note. "A slowdown in growth momentum will support disinflationary impulses in coming months, paving the way for the Fed to cut rates."

Capping price weakness, U.S. crude and fuel stockpiles all fell by more than expected in the week ending June 28, the Energy Information Administration said on Wednesday.

source: Reuters

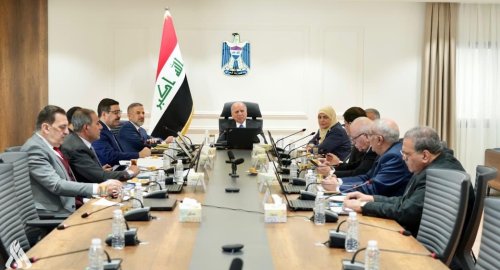

PM Al-Sudani chairs a special meeting on energy projects

- politics

- 07:58

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17

Hackers exploiting Microsoft Teams to gain remote access to user’s system

- Multimedia

- 24/12/17