Federation of Chambers of Commerce: Problems facing the commercial sector, solved

- 4-03-2023, 23:30

INA - BAGHDAD

The Federation of Chambers of Commerce announced upon facilities to solve problems facing the commercial sector.

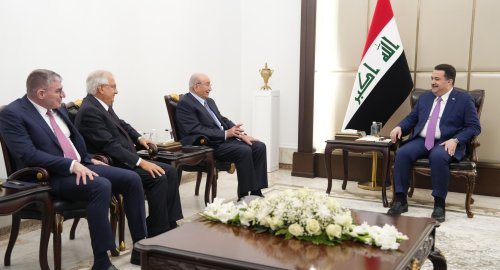

"The Federation of Chambers of Commerce, in cooperation with the Association of Iraqi Private Banks, held a forum and exhibition of banking and commercial services for merchants and businessmen, with the participation of the Central Bank, the Parliamentary Finance Committee, the Parliamentary Investment Committee, the advisor to the Prime Minister and representatives of the comercial chambers," according to a statement by the Federation of Chambers of Commerce, received by the Iraqi News Agency - INA.

The head of the Federation of Chambers of Commerce, Abdul Razzaq Al-Zuhairi, said in his speech, that "the forum will last for three days, with the participation of all effective institutions in this file, which are the Central Bank, the Association of Private Banks, and parliamentary committees with jurisdiction in addition to taxes and the Registrar of Companies with the aim of facilitating tasks for merchants and importers."

"The current days are vital for the private sector, and there are facilities by all institutions to solve the problems facing the commercial sector," he noted.

In turn, Deputy Governor of the Central Bank, Ammar Hamad, said, "The Central Bank is continuing the process of reforming the Iraqi banking system. We are currently focusing on the process of financing electronic commerce and publishing electronic payment tools."

"The Central Bank has worked on facilities for financing merchants and external transfer of trade, and there is a clear commitment in the law on combating money laundering to finance terrorism," he added.

On the other hand, a discussion session was organized at the forum that included the Chairman of the Parliamentary Finance Committee, Atwan Al-Atwani, the Chairman of the Parliamentary Investment Committee, Hassan Al-Khafaji, the Director General of Banking at the Central Bank, Qisma Salih, and the Director General of the Investments Department at the Central Bank, Mazin Sabah. It was moderated by the Executive Director of the Association of Private Banks, Ali Tariq.

The session focused on the problems of merchants and the requirements for opening a bank account, the mechanisms of external transfer and trade financing via direct meeting between banks, merchants and businessmen.

US Embassy: Trade Mission of 60 Companies Visits Iraq

- politics

- 25/04/07

CBI unveils comprehensive reform plan to modernize banking sector

- Economy

- 25/04/07

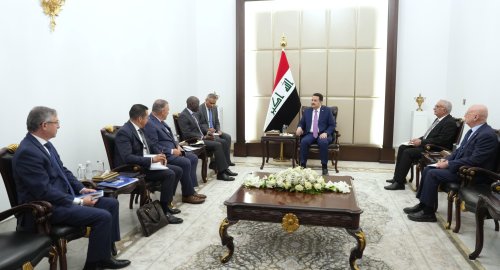

Al-Sudani Meets Delegation from J.P. Morgan Bank

- politics

- 25/04/08