Al-Kadhimi Advisor: $79 billion in Iraq's domestic and foreign debt

- 24-12-2021, 10:06

BAGHDAD-INA

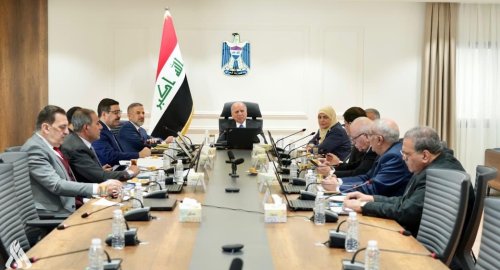

Prime Minister economic adviser Mazher Mohammed Saleh on Friday outlined the size of Iraq's remaining domestic and foreign debt and its repayment mechanism.

"For external debt, there is a pending amount that has not been settled under the Paris Club Agreement to settle Iraq's external indebtedness, and it dates back to the so-called debt before 1990, estimated at $41 billion, which requires that the debt be deducted by 80% or more under the terms of the Paris Club Agreement, no more than $8-9 billion," Saleh told the Iraqi News Agency (INA).

"The amount mentioned appears in the account books of four Gulf countries, with a ratio of about 66% distributed between Saudi Arabia, Kuwait, Qatar and the UAE, and dates back to the era of the Iraq-Iran war and is expected to be written off by 100% because it is a debt associated with wars and not for development purposes," he said.

"The remaining 34% will go back to eight different countries, and in general it can be said that the sovereign indebtedness of Iraq is divided between the Paris Club group and countries outside the Paris Club, and commercial debt," he said, adding that "Iraq's external debt, particularly debt before 1990, was settled under the Paris Club Agreement 2004, where it was agreed to write off 80% and more of those debts, whose initial estimates at the time were close to $129 billion, most of which were written off and most of them were written off. Schedule the rest of the debt over 20 years."

"Domestic public debt is the largest today and amounts to about $50 billion, but it is a debt exclusively among government financial institutions, and is settled within domestic economic policies, which is a low-risk debt," he said, noting that "increased oil revenues will provide high leverage to settle debt residues and easy choices."

"The real external public debt recalculation is $29 billion, and the total actual domestic and external debt is $79 billion, and assuming that gdp for 2021 is $178 billion, the ratio of actual debt to gdp is about 45%, and continues to fall within the safe range of EU standards of stability and growth," he said.

US Central Command: We killed ISIS terrorist leader Abu Yusuf in Syria

- International

- 24/12/20

Liverpool compete with Real Madrid to sign Olympique Lyonnais star

- Security

- 24/12/19

Iraq assumes presidency of Arab Investment Company’s Executive Board

- Economy

- 24/12/17

Hackers exploiting Microsoft Teams to gain remote access to user’s system

- Multimedia

- 24/12/17