PM advisor: The factors for stabilizing the purchasing strength of the Iraqi dinar

- 28-06-2023, 22:34

INA - BAGHDAD

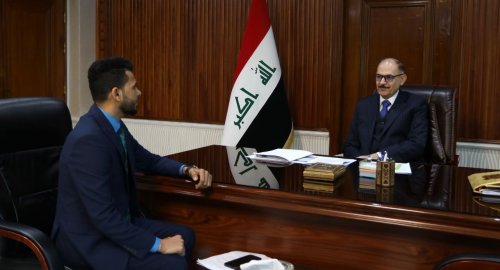

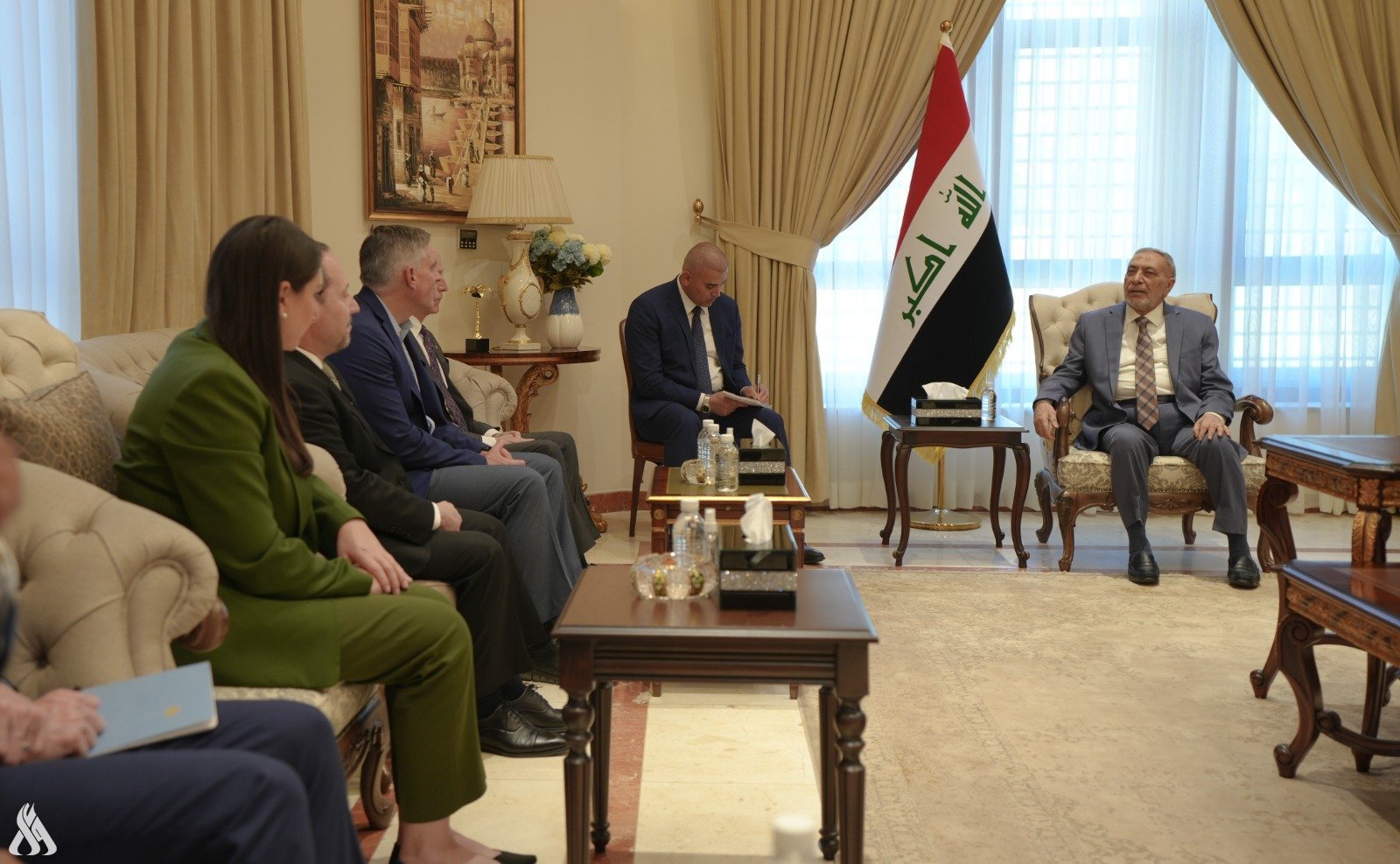

The Advisor to the Prime Minister for Financial Affairs, Mudher Muhammed Salih, confirmed the strength of quantitative and price monetary policy tools in managing public funds, while identifying factors for stabilizing the purchasing strength of the Iraqi dinar.

"Some are betting on the impossibility of controlling the levels of local funds generated by government spending, especially in the federal general budget 2023, which is based on methods of financing the budget in Iraqi dinars in exchange for oil revenues in foreign currency mostly. It constitutes oil revenues, the reserves of the Central Bank of Iraq, which help to intervene in the money market to sterilize local funds levels and control it when it rises via the ability to meet the growing demand for foreign exchange," said Salih to the Iraqi News Agency - INA.

He added, "The bet is losing on the inability to intervene and control liquidity levels in the dinar, which will rise with the rise in government expenditures due to the conditions of the compliance platform and the fear in terms of meeting the demand for foreign exchange. Monetary policy and the strength of foreign reserves, which are the highest in the country's financial history, are the only ones that possess the price tools. The different quantity affects the levels of funds that the government spending mostly generates."

Duhok of Iraq and Qadsia of Kuwait match kicks off

- Sport

- 25/04/15

Four Daesh terrorists detained in Salahuddin

- Security

- 25/04/14

PM: The value of investment licenses in Iraq reaches $88 billion

- politics

- 25/04/09