OPEC: IEA's path towards zero net emissions could increase oil price volatility

- 20-05-2021, 20:09

Follow-up -INA

OPEC confirmed today, Thursday, that a report from the International Energy Agency urges investors not to finance new oil projects in order to curb emissions that may lead to fluctuations in the price of crude if it is introduced.

On Tuesday, the Energy Agency said that investors should not finance new oil, gas and coal projects if the world is to achieve net zero emissions by mid-century, in the most severe warning yet about the importance of reducing fossil fuel consumption.

The research division of the Organization of the Petroleum Exporting Countries, whose thirteen members hold over 80 percent of global crude oil reserves, issued an internal document on the IEA report.

OPEC said, "The claim that there is no need for new investments in oil and gas after 2021 is in stark contrast to the conclusions repeatedly mentioned in other reports of the Energy Agency and may become a source of potential instability in the oil market if taken by some investors."

added that "a possible scenario in the report of the Energy Agency may affect the way companies invest and reduce the demand for oil. OPEC currently expects a strong recovery of oil demand this year and its continued rise until the thirties of this century."

"In the absence of greater international cooperation, global carbon dioxide emissions will not decline to net zero by 2050," OPEC said.

Source: Reuters

NASA pays tribute to Gagarin in honor of Cosmonautics Day

- Multimedia

- 10:12

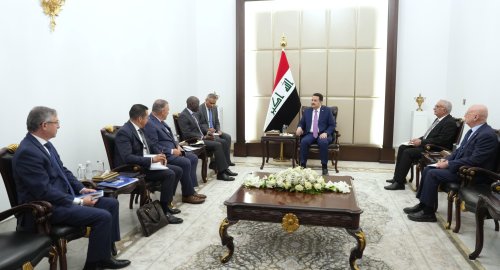

US Embassy: Trade Mission of 60 Companies Visits Iraq

- politics

- 25/04/07

CBI unveils comprehensive reform plan to modernize banking sector

- Economy

- 25/04/07

Al-Sudani Meets Delegation from J.P. Morgan Bank

- politics

- 25/04/08