INA discusses number of important files with CBI Governor

- 10-06-2023, 14:28

INA-Baghdad

The Central Bank of Iraq-CBI revealed Saturday, its plans to raise financial and gold reserves, clarifying its plans for restructuring government banks.

The Governor of CBI, Ali Al-Alaq, told the Iraqi News Agency (INA), that " "Packages of instructions for financing foreign currencies abroad were launched with the launch of the electronic platform," noting that "the aim of this package is to meet all the needs of the Iraqi economic sectors, in addition to the citizens' needs in terms of traveling, medical treatment and studying.”

Al-Alaq added, "These instructions contributed to organizing a large part of the trade process in Iraq through the entry of various sectors into the official channels of transfer, and mitigated exchange rate fluctuations, which reached approximately 160,000 dinars per dollar at the beginning of the launch of the platform in the market." , stressing that "there is a significant improvement in the work of the trade financing platform and the cash payment platform, and that proceeding in this framework will contribute to a significant decrease in the exchange rate in the coming days."

Reforms packages

He continued, "There is no need to launch new urgent packages at the present time, as the operations are proceeding consistently through e-platforms with the presence of some operational obstacles or obstacles related to international commercial financing, each case is resolved separately, and therefore we see that the situation is going towards stability and there is no need to take additional measures”.

Regarding setting $2,000 as a maximum limit for spending on Visa and MasterCard abroad, Al-Alaq explained, “The aim of setting ceilings for cash withdrawals from payment cards is to avoid misuse of these cards by weak-minded people and currency speculation, since continuing with the previous situation exposes the financial sector to a great threat and pushes for more currency smuggling.”

Seizing cards at airports

Regarding the operations of seizing cards at airports, the Governor of the Central Bank said: “We believe that this issue has ended or is to be ended through the circulars issued by CBI, that obligated banks and payment companies to issue one card for each customer and to use the biometric fingerprint, and to set ceilings for cash withdrawals and to cooperate with security services,”

Restructuring government banks

Regarding the central bank's plans to implement the government bank restructuring program, Al-Alaq explained, "The central bank's plans to implement the restructuring program continue, but the progress of this project is slow, because of its association with other parties related to the Federal Bureau of Financial Supervision and the Ministry of Finance, or because of weak human capacity of government banks."," pointing out that "the Central Bank continues to provide support to these banks to improve the quality of data, including conducting an assessment of the quality of assets for the Rafidain and Rasheed banks, as an international auditing company was contracted for this purpose, and this bank bore the cost of contracting with this company."

he continued: “As for private banks, the control process continues through the supervisory tools of this bank, and at the same time work is being done to update the instructions and controls regulating banking work and in cooperation with international institutions in order to implement international standards and international best practices, and the most prominent projects are the following: -

1- Supervisory work guide project / risk management controls in commercial banks.

2- Capital adequacy controls project.

3- Environmental, Social and Corporate Governance (ESC) Scorecard Project

4- 4- Work is currently underway to update the disclosures and financial statements of commercial banks, in cooperation with the Middle East Technical Assistance Center (METAC).

5- The project to develop regulatory tools to deal with systemically important local banks.

Money laundering operations

With regard to the Central Bank's procedures regarding monitoring money laundering operations and recovering funds smuggled abroad, Al-Alaq stated, "Based on Article 9 (9 / First / A) of the Anti-Money Laundering and Terrorist Financing Law No. (39), The work of the Anti-Money Laundering and Terrorist Financing Office is to receive or obtain reports or information about transactions that are suspected to include proceeds of a predicate crime, money laundering or terrorist financing from the reporting authorities. The office also receives the reports of the competent security authorities and the reports of the supervisory authorities in the Central Bank of Iraq, which showed the use of new methods for the purpose of misusing prepaid cards by criminals.”

He pointed out that "the office carries out investigations and analysis of the information received from the above authorities, on the basis of which the defaulters are identified from individuals, companies and banks, and a number of suspicious transactions have been referred to the courts specialized in combating money laundering and terrorist financing, based on Article (9 / first / c) of the above law, which states: Refer reports that are based on reasonable grounds of suspicion of money laundering, terrorist financing or predicate crimes to the Presidency of the Public Prosecution to take legal action in this regard, and notify the relevant authorities of that.

Plans to raise financial reserves and gold

Regarding plans to raise financial and gold reserves in CBI, Al-Alaq indicated that “the two most important factors that determine the accumulation and depletion of foreign reserves are external, as the accumulation of reserves is mainly linked to the amount of oil exports and the price of a barrel, while the depletion of reserves takes place through importing goods and services as well as transfers.” Foreign Affairs," stressing that "under normal conditions, this bank aims to build a sustainable level of foreign reserves while ensuring high liquidity and relatively good returns."

On plans to raise CBI financial and gold reserves, Al-Alaq indicated that "The two most important factors determining the accumulation and depletion of foreign reserves are external. The accumulation of reserves is mainly linked to the quantity of oil exports and the price of barrels, while the depletion of reserves is done through the import of goods and services as well as external transfers," affirming "Under normal conditions, this bank aims to build a sustainable level of foreign reserves while ensuring high liquidity and relatively good returns."

He continued, "With regard to gold, this bank places increasing its holdings of gold on a high level of importance, and by the end of this year, CBI aims to increase its holdings by at least the equivalent of $500 million."

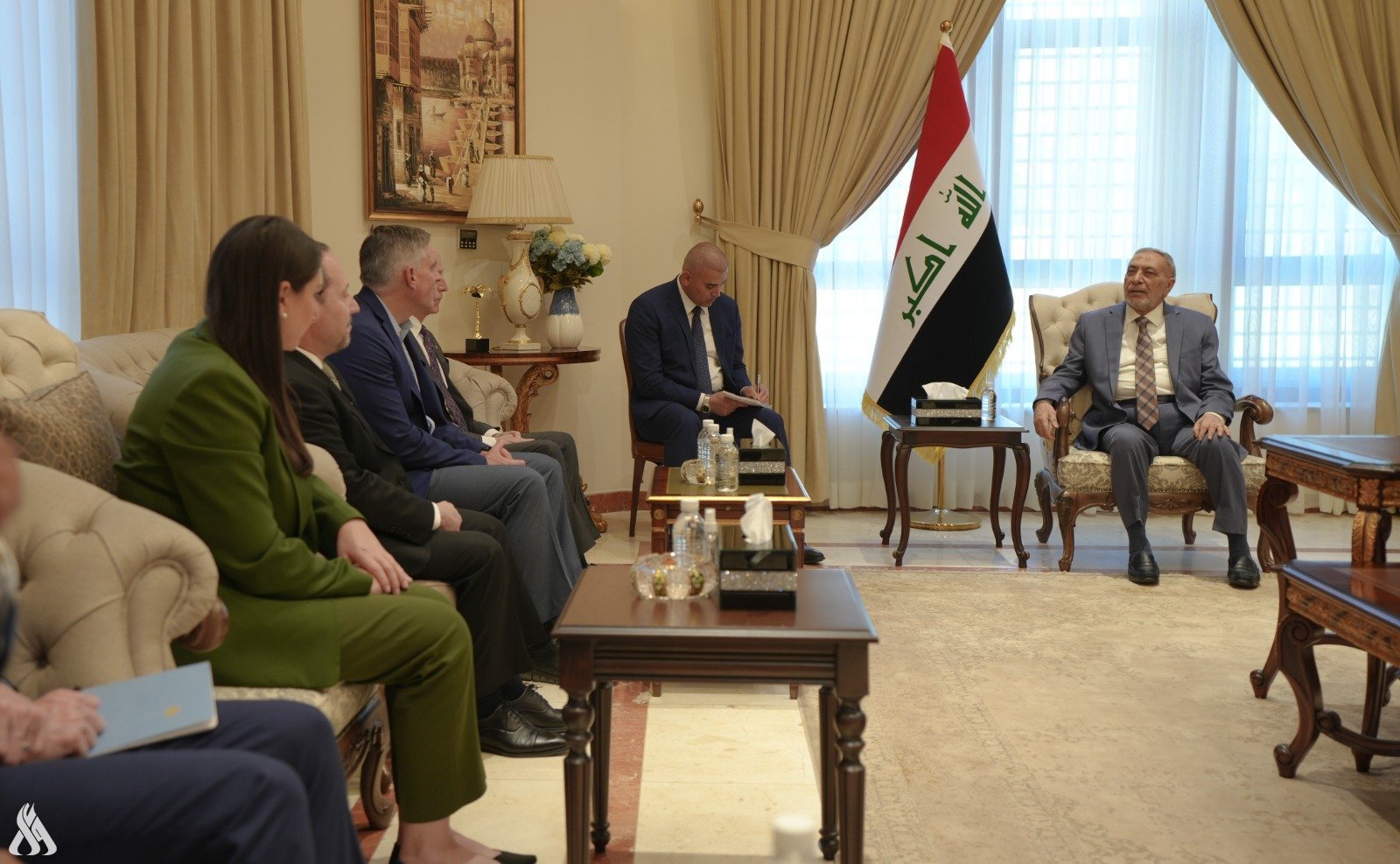

The Speaker of the Arab Parliament arrives in Baghdad

- politics

- 04:30

PM Al-Sudani offers condolences on death of writer Jumaa al-Lami

- Culture and art

- 02:54

Duhok of Iraq and Qadsia of Kuwait match kicks off

- Sport

- 25/04/15

Four Daesh terrorists detained in Salahuddin

- Security

- 25/04/14

Two ISIS hideouts destroyed, killing those inside in Salah al-Din

- Security

- 25/04/13