Al-Kadhimi’s advisor delineates the details of the proposed Sovereign Wealth Fund

- 4-12-2021, 14:17

Baghdad-INA

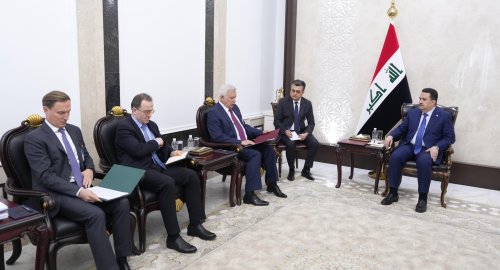

The financial advisor to the Prime Minister, Mazhar Muhammad Salih, clarified today, Saturday, the details of the proposed sovereign wealth fund to be established in Iraq, while specifying the entity responsible for its management.

"The world's sovereign wealth funds were established at least 6 decades ago and were built on the fact that the returns from the resources of the producing and exporting countries of raw materials as financial surpluses have become an important part of capital wealth that can be invested, maximized and continuously increased, rather than being consumed with large operating, often unproductive, annual budgets", Salih told The Iraqi News Agency (INA).

He added that "The principle of defining those returns from raw resources such as oil and other depleted natural wealth is not necessarily for consumer spending, but rather they are capital assets in themselves, which requires their sustainability and maximizing their growth by investing for the benefit of the nation in a profound cumulative way for wealth itself and across generations, and based on that and in order to serve current capital assets, resulting from the revenues of raw materials, including oil wealth, the majority of the oil-producing countries in particular have established sovereign investment funds from their surpluses from oil revenues and employed them as capital in various investment assets, whether financial or real and generating income to increase the capital as a growing wealth for the benefit of the people ".

He explained that "The Sovereign Wealth Fund is often managed by the executive authority as a direct sovereign authority and in cooperation between the country's financial and monetary authorities, as the performance of the Sovereign Fund is monitored the by legislators in the House of Representatives within the country's legislative assets and control rules."

"One of the most important axes discussed in the Iraqi Sovereign Fund at a symposium, held at the House of Wisdom ( Bait Al-Hikmaa ) last September ,was the dilemma (how could a deficit economy over the last 40 years to establish a sovereign wealth fund? Sovereign funds are a phenomenon that has arisen in surplus economies in general).

And he added: "The answer of this question is the adoption of a sovereign wealth fund directed to real investment inward within the framework of exceptional strategic economic and social development and in a different administrative style, which requires the presence of the state's economic sovereignty again in the management of the economic project by activating the idle projects and idle wealth of the public and private sectors, that is, in partnership with the market and foreign investment, and this will lead to the development of the national economy and its transformation into an economy of sustainable surplus on investment activities that lead to diversification of economy sectors".

He concluded his speech by saying: "In order to avoid legislative obstacles, it was proposed that the Iraqi Fund for Foreign Development in the Iraqi Ministry of Finance to be the legal basis for managing the next sovereign wealth fund for Iraq , following the agreement on the type, model and nature of the Fund, as it funds would necessarily be from the wealth of the State, mostly outside the public budget, by the financial and administrative partnership with the natural and moral wealth of persons”.

Trump: We've raised tariffs on China to 125%

- Economy

- 09:15

Wall Street Indexes Mixed as Trade War Escalates

- Economy

- 08:06

US Embassy: Trade Mission of 60 Companies Visits Iraq

- politics

- 25/04/07